Sensex breaks 2-day winning spree, ends lower at 35,871.48 pts on

Sensex breaks 2-day winning spree, ends lower at 35,871.48 pts on

Bhopal:MMNN: 23 February 2019

Mumbai, After the winning streak of past two days, the BSE Sensex declined on Friday by 26.87 points to end negative at 35,871.48 on profit-booking by local operators as well as losses in index heavyweights like RIL and HDFC Bank among others.

While, the Nifty of National Stock Exchange (NSE) went up a tad by 1.80 points to 10,791.65.

The Sensex went up by 8 points to 35,906.01 in early trade and then added gains of 43 points to touch day's high of 35,941.69 during the day. It later dropped nearly 100 points to hit day's low of 35,795.79 and then remained range bound throughout the day before closing at 35,871.48, easing by 26.87 points versus its last close.

The Nifty registered day's high and low at 10,801.55 and 10,758.40 points, respectively. The losses in sectoral indices like Bankex, Finance and Consumer Discretionary Goods & Services pulled the Sensex down, however, gains in Materials, FMCG, Utilities and Capital Goods capped its further decline, brokers informed.

The broader markets outperformed the Sensex, as the BSE Mid-Cap index and Small-Cap rose 0.38 per cent and 0.77 pc, respectively.

The market breadth was stronger on BSE, as 1,624 shares advanced compared with 912 declined and 149 were unchanged.

Piyush Goyal Favours Printing Currency To Finance Deficit

Piyush Goyal Favours Printing Currency To Finance Deficit

Bhopal:MMNN: 11 February 2019

NEW DELHI: Noting that finance ministers all over the world are perennially in search of revenue to balance government budgets, Union Minister Piyush Goyal on Sunday favoured printing currency as a way of deficit financing, citing the example of the US.

Mr Goyal's remarks follow his presentation of the interim Budget 2019-20 earlier this month, which contained major largesse for the stressed agriculture sector as well as tax sops for the middle class with implications for the fiscal deficit.

The fiscal deficit estimate for the current year has been revised upwards to 3.4 per cent of the gross domestic product (GDP).

"As finance ministers we are always in need of money," Mr Goyal said addressing the foundation day anniversary event of the state-run Security Printing and Minting Corporation of India (SPMCIL), and recalled that the Fiscal Responsibility and Budget Management Act (FRBM), 2003, had been enacted during the Atal Bihari Vajpayee-led NDA government.

The FRBM Act aims to institutionalise financial discipline, reduce fiscal deficit, improve macroeconomic management and the overall management of the public funds through a balanced budget.

"I have heard that the US does deficit financing only by printing currency," Mr Goyal said.

He told the gathering in jest that as finance minister he would have been happier if he had known of SPMCIL's recent creditable performance on both the production and profit fronts.

SPMCIL, which supplies bank notes, coins and security documents to the central government and the states, posted a net profit of Rs. 630 crore last year, of which Rs. 200 crore has been handed over to the government as dividend.

According to senior officials, the company is on course to print 10,000 million pieces by the end of the current fiscal ending March.

Sensex crashes by 424.61 pts

Sensex crashes by 424.61 pts

Bhopal:MMNN: 9 February 2019

Mumbai, The benchmark index of Bombay Stock Exchange (BSE) on Friday dropped by 424.61 points to settle at 36,546.48 as sell-off in the automobile and metal stocks amid weak global cues.

The Nifty of National Stock Exchange (NSE) was too down by 125.80 points at 10,943.60.

The Sensex registered the day's high and low at 36,885.58 and 36,480.62 points respectively.

The Nifty registered day's high and low at 11,041.20 and 10,925.45 points, respectively.

Banks' strike on Jan 8, 9; operations affected

Banks' strike on Jan 8, 9; operations affected

Bhopal:MMNN: 8 February 2019

New Delhi, Banking services were affected across the country as bank unions have called for a two-day strike on January 8 and 9, demanding a better pay hike and rollback of Bank of Baroda, Vijaya Bank and Dena Bank merger.

The All India Bank Employees Association (AIBEA) and the Bank Employees Federation of India have already informed the Indian Banks Association (IBA) about the two-day nationwide strike.

The IDBI bank in a stock exchange filing said: "It is advised that the bank is in receipt of notice of two days nationwide strike on January 08-09, 2019 from All India Bank Employees Association (AIBEA) & Bank Employees Federation of India addressed to the Chairman, Indian Bank's Association (IBA), in support of their various demands."

The Allahabad Banks also said the IBA has advised the bank that the AIBEA and the BEFI have served notice informing their decision to go on two days strike on 08th and 09th January, 2019 in support of their certain demands.

The issues and demands are of industry level and strike call is also given at industry level. Therefore, if the strike takes place, the functioning of branches of the bank may be affected. The bank is taking all the necessary steps in terms of the existing guidelines for smooth functioning of bank's branches/offices on the day of strike(s), in the event the strike materialises, the bank added.

Besides AIBEA and BEFI, the bank union which are supporting the hartal included INTUC, AITUC, HMS, CITU, AIUTUC, AICCTU, UTUC, TUCC, LPF and SEWA.

Due to the strike, the banks would be functional only for three days - Monday, Thursday and Friday. Second Saturday is again a weekly holiday.

The bank hartal was the third strike within past 20 days. Prior to this, the bank unions have called for a strike on December 21 and December 26.

Tech Mahindra Hits 52-Week High On Profit Beat In Q3

Tech Mahindra Hits 52-Week High On Profit Beat In Q3

Bhopal:MMNN: 6 February 2019

Tech Mahindra shares surged as much as 6.66 per cent to a fresh 52-week high of Rs. 800 after its quarterly profit beat analysts' estimates. Tech Mahindra's net profit rose 13 per cent in the quarter ended December 31, 2018 as against Rs. 1,064.3 crore in the previous quarter. Analysts had on an average expected the net profit at Rs. 1,103 crore, news agency Reuters reported citing Refinitiv data. Tech Mahindra's revenue from operations advanced 3.63 per cent to Rs. 8,943.7 crore in the December quarter, as against Rs. 8,629.8 crore in the previous three-month period.

The company reported a strong operating performance with a 6.4 per cent increase in its operating profit - or earnings before interest, tax, depreciation and amortization (EBITDA) - to Rs. 1,723 crore. Tech Mahindra said its margins rose by 50 basis points to 19.3 per cent sequentially.

Commenting on the quarterly performance, CP Gurnani, the company's managing director and chief executive officer, said, "This is a milestone quarter for Tech Mahindra with 5 billion dollars annual revenue run rate in sight. The current quarter has been impressive on all fronts, delivering steady growth in enterprise and communications business along with margin expansion. Our Run, Change and Grow strategy has helped us deliver a strong 10 per cent sequential growth in digital revenues. We are confident of continuing the growth momentum."

Here are some of the key deal wins in the December quarter, as reported by the IT company in its regulatory filing:

Engaged by a telecom company in UK, as a partner in their transformation journey. Tech Mahindra will be responsible for driving improved customer experience through Next-gen transformation, automation and system rationalization.

Bagged a contract from one of the largest banks in the Australia New Zealand region for digital channel integration across core banking processes and asset finance.

Selected by a leading provider of jet engines and components for commercial and military aircraft as its partner for digital transformation solutions and cloud migration services, leveraging Tech Mahindra's delivery excellence.

Awarded a multi-year, multi-million dollar, customer experience transformation deal, by one of the largest railroad companies in North America for technical infrastructure management and enterprise security, using best-in-class artificial intelligence and automation-based solution.

Selected by a leading healthcare solution and device manager as long-term, strategic partner for engineering services leveraging Tech Mahindra's expertise in Next-Gen technologies.

Dewan Housing Finance Sinks to Over Five-Year Low Amid Allegations of Financial Mismanagement

Dewan Housing Finance Sinks to Over Five-Year Low Amid Allegations of Financial Mismanagement

Bhopal:MMNN: 4 February 2019

Bengaluru: Shares in India's Dewan Housing Finance Corp Ltd plunged on Monday to their lowest in over five years as claims of financial mismanagement and broader sectoral woes continue to plague the home loan provider.

Investigative media outlet Cobrapost had alleged last week that loans from Indian state banks were diverted by Dewan to shell companies, including those linked to its controlling shareholders.

Dewan has, however, denied lending to shell companies and said it had not received any communication from the government in relation to an investigation.

Separately, Dewan said on Saturday it would sell a 9.15 percent stake in housing finance firm Aadhar Housing Finance Ltd to private equity funds managed by Blackstone Group LP. Wadhawan Global Capital will also sell its 70 percent stake in Aadhar Housing to Blackstone.

Dewan's shares fell as much as 13 percent to 96.8 rupees on Monday, their lowest since Dec. 23, 2013. They were last down 5.8 percent at 104.90 rupees as of 0400 GMT.

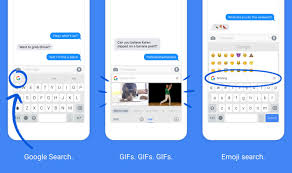

Budget 2019 Brings Cheer to Startup Sector as Govt Promises 1 Lakh Digital Villages

Budget 2019 Brings Cheer to Startup Sector as Govt Promises 1 Lakh Digital Villages

Bhopal:MMNN: 2 February 2019

Mumbai: The startup sector has welcomed the interim budget proposal of setting up one lakh digital villages saying that it will give boost to the sector.

Taking forward government's Digital India programme, Finance Minister Piyush Goyal Friday said that the government has set an aim of building one lakh digital villages in the next 5 years.

The initiative to set up of one lakh digital villages when rolled out will have multiplier effect on startups in segments like edutech, content based companies, media tech and of course fintech and e-commerce," Unicorn India Ventures managing partner Anil Joshi said.

This will ensure faster financial inclusion of people who still continue to be outside of formal banking system and have no credit history. Startups working in fin tech and edutech should see this as a promising opportunity to tap the unaddressed and underserved rural population, Joshi said.

City-based cyber security startup Sequretek welcomed the government's focus on artificial intelligence, as other countries have already made a start by investing heavily in AI and lead initiatives to become a data rich economy. Bengaluru-based fin tech startup in direct lending segment Smartcoin said the initiative to build one lakh digital villages would mean more money being transacted digitally as the country possibly has the lowest penetration

when it comes to mobile and data tariffs in the world.

"Digitally progressive would also mean better internet connectivity and hence we expect the untapped rural consumers to start using digital payments. For us, this means more alternate data generated to assess loan seekers. And over time a formal credit history will be built, as they will not only transfer money but also take micro loans for their needs. For a fin tech company in

direct lending space like ours, this is a huge push to achieve our vision of bringing under banked masses under a formal credit system, it said.

Noting the move to enhance tax exemption for salaried employees and digitising the entire tax filing process, Fintech company Zeta's co-founder Bhavin Turakhia said, "The decision to carry all tax verifications via an anonymous digital interface and processing all tax returns within 24 hours displays the government's strong intention to build a digital nation, whilst putting convenience in the hands of its citizens and ensuring complete transparency."

Wearable devices-maker Goqii that is backed by Ratan Tata and Paytm founder Vijay Shekhar Sharma, among others, said healthcare announcements made in the budget are a welcome move and will help build a strong economy.

Union Budget 2019: Top 5 Announcements By Piyush Goyal In Election Year

Union Budget 2019: Top 5 Announcements By Piyush Goyal In Election Year

Bhopal:MMNN: 1 February 2019

NEW DELHI: Union Minister Piyush Goyal today presented the last Interim Budget of the NDA government led by Prime Minister Narendra Modi before the Lok Sabha elections due by May. From direct cash transfer to small farmers and better gratuity terms to income tax relief, the Interim Budget appeared to be keeping the national elections in its radar.

Here are the top 5 announcements by Piyush Goyal:

1-Individual taxpayers with annual income up to Rs. 5 lakh will get full tax rebate. Individuals with gross income up to Rs. 6.5 lakh will not need to pay any tax if they make investments in provident funds and prescribed equities. Around three crore middle class taxpayers will get tax exemption due to this measure.

2-Within the next two years, assessment of all tax returns should be done electronically without any personal interface. Direct tax collections up from 6.38 lakh crore in 2013-14 to almost 12 lakh crore; tax base up from 3.79 crore to 6.85 crore. All income tax returns to be processed within 24 hours.

3-The PM Kisan Samman Nidhi Yojana will provide assured income support of Rs. 6,000 per year to small and marginal farmers with landholding below two hectares, through direct cash transfer. It will be paid in three installments of Rs. 2,000.

4-"EPFO shows two crore accounts in two years. This shows formalisation of the economy. When there is such a high growth, jobs are created," Piyush Goyal said. Gratuity limit has been increased from Rs. 10 lakh to Rs. 30 lakh.

5-Pension scheme for unorganised sector workers with monthly income up to Rs. 15,000 will be given. Assured monthly pension of Rs. 3,000 after they retire on reaching 60.

Trivago-fame guy Abhinav Kumar joins Paisa Dukan's advisory board

Trivago-fame guy Abhinav Kumar joins Paisa Dukan's advisory board

Bhopal:MMNN: 30 January 2019

New Delhi, Leading Peer to Peer (P2P) online money lending marketplace Paisa Dukan on Tuesday announced Trivago-famed guy Abhinav Kumar has joined its Board of Advisors.At Paisa Dukan, Mr Kumar will look after the digital marketing and branding space.

Talking to Agencies, Paisa Dukan CMD Rajiv Ranjan said, "While the entire Fintech industry works on the concept of digitization to provide contactless financial solutions with Abhinav coming in the advisory board of the Paisa Dukan, his experience will help in to elevate our digital marketing strategy. I also see an exponential growth in our digital footprint in next quarter."

The Mumbai-based firm is playing a pivotal role in providing their clients with the finest financial platform to create a smart way of lending or borrowing money in a transparent way.

"The peer to peer marketplace is an interesting thing and the way internet population is growing it would be beneficial for both the lending and borrowing fraternity. The loan seekers can get the loan easily while the young salaried class who are in search for avenues investing their savings can take advantage of this platform," Mr Abhinav Kumar told UNI on his joining at the Paisa Dukan.

"I believe that my experience will help the company in creating a niche marketplace for lending and borrowings," Mr Kumar added.

Recently, the company had appointed independent director at Yes Bank U P Agarwal and former CFO of Infosys V Balakrishnan in the Board of Advisors.

Mr Kumar is currently heading the Trivago's country development of India. An alumnus of University DI Trento has an experience of around a decade in the field of digital marketing. He has done his graduation in Commerce from Pune University and schooling from Ranchi-based Bishop Westcott Boys' School.

Budget: Relief package for farmers including interest-free loan likely to address agrarian distress

Budget: Relief package for farmers including interest-free loan likely to address agrarian distress

Bhopal:MMNN: 29 January 2019

New Delhi, With the announcement of Lok Sabha elections barely a few weeks way, one of the most awaited budgets for the farming community is the one to be presented on February 1 by Finance Minister Piyush Goyal.

It is expected that the government will come up with a relief package for farmers that will include interest-free credit for growers to address agrarian distress. The outgo for this measure could be an estimated Rs 26,000 crore.

The government also looked at the possibility of replicating Telangana government's Farmers Investment Support Scheme which involves payment of Rs 4,000 per acre for each farmer.

If implemented in the entire country, the outgo for this is expected to be over Rs 1.5 lakh crore and therefore, much thought is going into it.

Pre-budget consultations also threw up the idea of a Universal Basic Income which was mentioned in the 2015-16 Economic Survey Report presented by then Finance Minister Arun Jaitley.

However, on Monday, Congress president Rahul Gandhi beat the Modi government to it and announced Minimum Income Guarantee Scheme for poor if voted to power.Such a scheme will benefit 40 per cent of the population, including small farmers, the party said.

In Its Economic Survey Report, the Modi government had hinted at a Universal Basic Income costing about 4.5 to 5 per cent of the GDP replacing all subsidies, including food and fertiliser.But whether all this is possible in a vote-on-account budget or interim budget is under debate.

In all of its five years in power since 2014, the Modi government has resisted pressure for loan waiver of farmers' credit, whereas the Congress Party has played upon this theme which paid the party dividends in the Assembly elections in Punjab, Madhya Pradesh, Rajasthan and Chhattisgarh.

The BJP did the same in Uttar Pradesh in 2016 elections where it won handsomely.Instead of loan waiver, the Modi government expressed its commitment to doubling farmers' income by 2022.

It took measures to that effect including bringing more hectares under cultivation, e-National Agriculture Market to link mandis, Soil Health Card, Pradhan Mantri Fasal Bima Yojna, Pradhan Mantri Krishi Sinchai Yojna and Pradhan Mantri Annadata Aay SanraksHan Abhiyan.

Recently, the government raised the Minimum Support Price of Kharif crops to 1.5 times of production cost.

It also took measures to create a buffer stock for pulses and gave generous package to sugar millers to pay off farmers. It also experimented with the Price Differential Scheme of the previous Madhya Pradesh government.

By all accounts much of the problem lies with implementation of schemes by states and union territories be it payment of Minimum Support Price to farmers, the price for sugarcane to growers or providing proper relief/compensation to farmers in times of distress or natural calamity.

In the last budget, the central government provided incentives to Farmer Producer Companies (FPC) and the Food Processing Industries with encouraging results.

If the BJP-led National Democratic Alliance government and the major opposition agree on reducing farm distress there should be unanimity in providing succour rather than show one another down during elections.

GST biggest economic reform, make India ideal destination for investment : Nirmala

GST biggest economic reform, make India ideal destination for investment : Nirmala

Bhopal:MMNN: 24 January 2019

Chennai, Defence Minister Nirmala Sitharaman on Wednesday said systematic reforms have been taken up courageously by the Centre under the leadership of Prime Minister Narendra Modi and one such measure was the GST, which was the India's biggest economic reform.

Inaugurating the second edition of the TN Global Investors Meet (GIM) 2019 here, she said these reforms had made India an ideal destination for those who want to invest.

While talking about the present industry scenario in the country, she said India was seen as bright spark all over the world for ease of doing business. She also made a note on recent IMF report which says that India's growth will sustain.

Appreciating the Tamil Nadu government for bringing a policy on Aerospace industry, Ms Nirmala invited the global trade community to invest in these sectors and promised full support from the Centre.

She said Tamil Nadu has shown interest in industrial growth for centuries. 'For example, Cholas had taken the Tamil Nadu culture all over the world through industrial ties and Poompuhar was one of the popular port of that time', she added.

'We have lot of trade associations today like CII, Assocham. But Tamil Nadu was known for having trade associations even in Chola period and there are some inscriptions regarding this in various countries like Thailand, Cambodia and so on', Ms Nirmala added.

She pointed out that Tamil poet Subramania Bharathi had insisted on making business globally in his writings.

Non-Filers Asked To Submit Income Tax Returns Within 21 Days: 10 Things To Know

Non-Filers Asked To Submit Income Tax Returns Within 21 Days: 10 Things To Know

Bhopal:MMNN: 23 January 2019

If you haven't filed your income tax return yet, you have few days left to do so to avoid legal proceedings. Individuals who have not filed their income tax returns (ITR) for the assessment year 2018-19 should do the same within 21 days to avoid proceedings under the Income Tax Act, news agency IANS (Indo-Asian News service) reported citing a government statement. The Central Board of Direct Taxes (CBDT) had identified through the Non-filers Monitoring System several potential individuals who had carried out high value transactions in financial year 2017-18 but had still not filed returns, the agency reported.

Here are 10 things to know about CBDT's warning to non-ITR filers:

1- carried out an analysis to identify non-filers about whom specific information was available in its database of the Income Tax Department.

2-"Non-filers are requested to assess their tax liability for assessment year 2018-19 and file the ITR or submit online response within 21 days," it said in the statement.

3-If the explanation offered is found to be satisfactory, matters will be closed online. However, in cases where no return is filed or no response is received, initiation of proceedings under the Income-tax Act, 1961 will be considered," it added.

4- reiterated that there was no need to visit any Income Tax office for submitting a response as the entire process can be completed online.

5-Taxpayers can access information related to their case from the compliance portal' accessible through the e-filing portal- incometaxindiaefiling.Gov.In.

6-Meanwhile, the CBDT has directed the I-T department to withdraw all appeal cases from various courts by this month-end as part of the government's drive to end frivolous litigations.

7-These include cases pertaining to certain monetary limits and parameters.

8-The entire exercise of withdrawal of appeals must conclude by the end of the month and withdrawal figures should be intimated to the board by January 3.

9-CBDT or Central Board of Direct Taxes, a statutory authority functioning under the Central Board of Revenue Act, 1963, is the apex policymaking body of the Income Tax Department.

10-The officials of the board function as a Division of the Ministry dealing with matters relating to levy and collection of direct taxes.

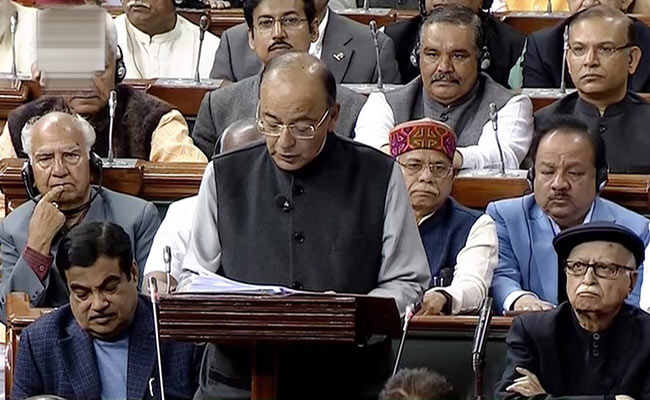

Interim Budget: 'Halwa ceremony' held without Jaitley

Interim Budget: 'Halwa ceremony' held without Jaitley

Bhopal:MMNN: 22 January 2019

New Delhi, To mark the ceremonial beginning of printing of the Interim Budget 2019, the Finance Ministry on Monday organised the "Halwa Ceremony" in the absence of Union Finance Minister Arun Jaitley.

Both Ministers of State for Finance Shiv Pratap Shukla and P Radhakrishnan shared the customary halwa with finance officials at the ceremony held at the North Block here.

Union Finance Minister Mr Jaitley was not present during the halwa ceremony as he was in the US for the treatment. He has been diagnosed with Cancer.

The event marks significance as once the sweet dish is served, a large number of officials and support staff, who are directly associated with the budget making and printing process, are required to stay in the ministry and remain cut off from their families till the presentation of the Budget in the Lok Sabha

The Interim Budget would be presented in Parliament on February 1.

TRAI Chairman bets big on 5G; says it is digital tomorrow

MMNN:18 January 2019

New Delhi, With digital media on a roll in recent times, TRAI chairman Ram Sevak Sharma said on Thursday that the 5G will be the digital tomorrow of this nation of fast growing internet consumers.

"5G spectrum, unlike the previous spectrums of 2G, 3G and 4G will not be focusing on high speed or connectivity only. Rather it will be an important and horizontal platform where multiple applications will ride fine, especially the real-time and M2M apps, because of the very little latency feature," Mr Sharma said here.

He was speaking at the first day of the 13th India Digital Summit, organised by the Internet and Mobile Association of India (IAMAI).

Mr Sharma was positive and hopeful about the Government's regulations and policies, and believes that the huge investments required by the 5G spectrum and infrastructure to be available to entire India can be possible by favourable initiatives taken by the Government.

OTT or over the top content is considered to be another strong point of digital India's future, he added.

Microsoft's M12 expands investment reach to India

MMNN:17 January 2019

Bangalore, M12, Microsoft's corporate venture fund, on Wednesday announced that it would extend its investing coverage to India to help entrepreneurs innovate and grow with Microsoft's reach, expertise, and technologies. Rashmi Gopinath, partner at M12, will be leading M12's investments in India.

Microsoft continues its portfolio of investment in the Indian startup ecosystem with M12 announcing its first India investment, Innovaccer, a startup working to solve data interoperability challenges in healthcare and helping health systems enhance their clinical and financial outcomes with a data-first approach.

Venture capital investments in Indian tech business-to-business (B2B) start-ups have been trending upwards with over 3.09 billion dollars raised in equity funding across 415 deals in 2018, 28 per cent more than 2.41 billion dollars invested in 2017.

Moreover, an increasing number of enterprise B2B startups are being founded in India that cater to a global customer base, most notably in artificial intelligence and machine learning, robotics, software as a service (SaaS), data analytics and Internet of Things (IoT). These sectors continue to be top strategic priority focus areas for Microsoft and M12 as well.

In addition, India offers unique competitive advantages by being home to top technical talent in the world including deep tech areas such as computer vision, robotics, blockchain and autonomous driving. These factors position India favourably to support highly innovative startups that can effectively compete on a global scale.

Innovaccer is a shining example of the startup opportunity in India. The healthcare SaaS startup has offices in both India and the United States, offering a comprehensive Healthcare Data Platform and intelligent care application modules for over 10,000 healthcare providers across 500 practice locations.

Leveraging machine learning and healthcare-related contextual expertise, Innovaccer enables its users to consolidate financial, claims, patient, and operational data together to provide a comprehensive patient 360-view for better decision-making, care coordination, and reporting.

India's retail inflation comes at 18-month low of 2.19 per cent

MMNN:15 January 2019

New Delhi, India's November retail inflation slumped to 2.19 per cent in December 2018 against 2.33 per cent in November and 3.38 per cent in October.

The Central Statistics Office (CSO) data on Monday showed the Consumer Food Price Index (CFPI) rose to (-)2.51 per cent from (-)2.61 per cent in November.

According to data, Food and Beverages recorded (-)1.49 per cent , Pan Tobacco and intoxicants recorded 5.77 per cent retail inflation.

Clothing and Footwear stood at 3.52 per cent and Housing at 5.32 per cent.Vegetables recorded 16.14 per cent, Fruits, (-)1.41 per cent and Pulses & Products saw (-) 7.13 per cent retail inflation.

Fuel and Light registered retail inflation at 4.54 per cent.

India A Bright Spot In Global Economy: Vice President M Venkaiah Naidu

MMNN:14 January 2019

MUMBAI: Vice President M Venkaiah Naidu on Saturday said a steady growth rate of almost 7 per cent coupled with a series of reforms made India the most favourite destination for investments in the world. He said India would continue to be the fastest growing major economy. Quoting the World Bank's latest forecast, he said GDP (gross domestic product) is expected to grow at 7.3 per cent this fiscal year and at 7.5 per cent in the following two years.

"It is the right time for foreign investors to tap the huge potential offered by India in various sectors from real estate to healthcare," Mr Naidu said, addressing the inaugural session of the Confederation of Indian Industry's (CII) Partnership Summit on the theme 'New India: Rising to Global Occasions'.

The government's initiatives and reforms helped India achieve the 11th rank in the Global FDI confidence index 2018, Vice President's Secretariat said in a statement.

"The annual FDI inflows would rise to $75 billion over the next five year and India with its growth momentum would soon become a $5 trillion economy," he said referring to a report by Swiss bank UBS.

Mr Naidu said the robustness of India's institutions, resilience of its policy frameworks, reforms initiated by the government and responsiveness of industry bodies such as CII have insulated its economy from stagnation and helped in achieving the dual distinction of being a stable democracy and one of the fastest growing economies in the world.

Appreciating the healthy competition among states to attract investors, Mr Naidu said the public-private partnership model was the way forward for effective implementation of infrastructure projects like construction of airports in Hyderabad, Delhi, Bengaluru and Mumbai.

He observed that the increasing internet penetration in rural India provides a great opportunity to improve rural India. Connecting all gram panchayats with optical fibre network under the BharatNet project by March 2019 would transform rural India, he said.

Advising the industry to promote innovation and research and development, he urged industry bodies like CII to promote business ethics, values, transparency and accountability.

Mr Naidu called upon the business community to share more of their wealth through Corporate Social Responsibility initiatives to address challenges like poverty, illiteracy, double burden of infectious diseases and non-communicable diseases and unemployment.

Calling terrorism a global concern that demands global attention and cooperation, he said the United Nations should conclude the Comprehensive Convention on International Terrorism at the earliest.

"Terror is enemy of humanity, we must see to it that is eliminated the earliest... the world community also should ensure that economic fugitives get extradited without delays," he said.

CII welcomes proactive measures taken by GST Council in its 32nd meeting

MMNN:12 January 2019

New Delhi, CII strongly welcomed the proactive measures taken by the GST Council in its 32nd meeting held on January 10.

"The GST Council led by Finance Minister Arun Jaitley has once again shown its complete commitment to ensuring a smooth and facilitative indirect tax regime in the country," stated CII Director General Chandrajit Banerjee on Friday.

In a statement here, the CII noted that the GST Council, since the introduction of the GST in July 2017, has continuously moved towards a simpler tax system.

It has steadily reduced the tax rates on many items, ensuring a movement towards a 3-slab GST structure with a standard rate, a higher demerit rate and a lower rate for items consumed by the poor.

The Council has further proactively addressed procedural matters, enabling smaller enterprises to file returns at intervals and extending the time for adjustment. It has also taken up issues of consistency to minimize disputes and litigation, stated the CII press release.

The CII said that the Council's decision to double the threshold limit for exemption from registration and payment of GST to Rs 40 lakh in the general category states brings huge relief to lakhs of small enterprises. These would no longer be liable to prepare returns and pay taxes from April 1, 2019, enabling them to conduct their business smoothly.

The confederation welcomed the extension of the composition scheme for services in particular. It stated that including suppliers of services and mixed suppliers under the composition scheme with a tax rate of 6 per cent would greatly help small service providers and professionals earning less than Rs 50 lakhs per annum.It would lower costs for buyers of these services down the supply chain as well.

The CII had recommended including services enterprises under the Composition Scheme and thanks the GST Council for this decision.

Felicitating the GST Council for raising the turnover limit for the composition scheme from Rs 1 crore to Rs 1.5 crore, CII said that this would release numerous small enterprises from the procedural burden. Further, these enterprises can file returns annually, freeing them from the need to maintain documents on a quarterly basis.

A key decision of the GST Council was to set up a group of ministers to look at the possibility of introducing the composition scheme for the residential real estate sector. The residential sector has been impacted due to the divergence between GST on under-construction and finished houses as well as introduction of Real Estate Regulation Act (RERA) simultaneously.

CII hopes that the committee would provide relief to the housing sector, particularly low-cost housing.With such progressive decisions from the GST Council headed by Finance Minister Arun Jaitley, CII is confident that GST will emerge as a game-changer for the Indian economy and fulfill the promise of adding 1-1.5 percentage points to the GSP growth rate within the shortest period of time.

UST Global to host upcoming TEDx Talk on Jan 20

MMNN:11 January 2019

Thiruvananthapuram, UST Global will host the upcoming TEDx Talk at its campus here on January 20.TEDx is the city level event in Kerala and is the largest independently organized in the state.

TEDx stands for Technology, Entertainment and Design, and the 'x' standing for independently organised event proclaims the slogan, 'Ideas Worth Spreading'.

TED Talk have lively discussions on a range of relevant issues and was initiated by an American non-profit organisation called the Sapling Foundation in 1990.

TEDxThiruvananthapuram has 10 diverse speakers who have been selected after careful consideration and with whom the team has been working with to curate talks and ideas relevant for the city.

District collector Dr. Vasuki, DGP Prisons R. Sreelekha, Renowned International Mathematician Dr. Joseph Gheverghese George and several other innovators and changemakers would be speaking at TEDxThiruvananthapuram.

The presenting partner of TEDxThiruvananthapuram is UST Global.

A festival for the curious, these talks seek to facilitate the exchange of unique ideas and thereby cultivate a more inspired and thoughtful community, yearning for positive change.

Steve Jobs, Bill Gates, Bill Clinton, Shahrukh Khan and the Pope figure among some of the prominent personalities who have been part of the TED talks, that are held on an annual basis.

The organizers' move to democratise the phenomenon in 2009 saw TED going viral, not merely online but the world over with the 'x' suffix getting attached to the acronym.

Denoting 'independently organised event', these talks broke out of its more elite, American intelligentsia barrier and spread to remote locations across the world.

The local-level TED experience is further encouraged by the fact that the licences are let out for free, albeit after fulfilling an exhaustive criteria.

Moreover, specific issues of that particular location are discussed rather than the initial focus being on the terms in the acronym.

TEDxThiruvananthpuram is one of the few events that aims to spread inspiring Ideas in the local community.

Electric vehicles have potential to support India's growth: Jaitley

MMNN:10 January 2019

New Delhi, Electric mobility helps in reducing adverse impact of climate change and at the same time electric vehicles have the potential to support the India's growth by enhancing manufacturing, job creation and technical capabilities, Union Finance Minister Arun Jaitley said on Wednesday.

"Electric mobility is an attractive, sustainable and profitable solution to mitigate adverse impact of climate change and the threat to public health caused especially by vehicular emission," Mr Jaitley said.

He said EVs have the potential to support India's growth by enhancing manufacturing, job creation, and technical capabilities. "We are glad to be a part of India's mission of rapid adoption of e-mobility."

He was speaking after launching the induction of 15 Electric Vehicles in the Department of Economic Affairs, Ministry of Finance along with Union Power and New and Renewable Energy Minister RK Singh.

The electric vehicles will reduce dependence on oil imports and promote power capacity addition in India thereby enhancing energy security of the country. It will further reduce GHG emissions from the transport sector and also positively impact the pollution level in the cities.

Marking the adoption of e-mobility, the Department of Economic Affairs has signed an agreement with Energy Efficiency Services Limited (EESL), an entity under the Ministry of Power for deployment of 15 EVs for their officers.

Also, 28 charging points (24 slow charging points charging in six hours and four fast charging points charging in 90 minutes) have been installed at the North Block for charging these vehicles.

With the induction of these 15 vehicles being provided on lease basis for a period of five years, the Department is expected to save over 36,000 litres of fuel every year besides leading to reduction of over 440 tonnes of CO2 annually. These vehicles are automatic and fully air-conditioned with zero emission.

The Government will also save in maintenance and operating cost which is almost one fourth in comparison to an internal combustion engine.

The development marks the Department's participation in India's e-mobility goal of 30 per cent fleet electrification by 2030. The Department of Expenditure has also issued an office memorandum for all the government offices in Delhi to switch over to electric vehicles.

Fuel prices witness a hike on Monday; petrol gets costlier by 21-22 p/l

MMNN:8 January 2019

New Delhi, Fuel prices increased on Monday after a gap of 20 days as the price hike comes on the back of an increase of over 8 per cent in brent crude oil rates in the last seven days.

Petrol prices were hiked by 21-22 paise per litre across major cities while diesel became costlier by 8-9 paise per litre.

In the national capital, petrol is retailing at Rs 68.50 a litre while diesel costs Rs 62.24 per litre.In Mumbai, petrol is retailing at Rs 74.16, becomes costlier by 21 paise while diesel price was hiked by 8 paise per litre to Rs 65.12.

Similarly, in Noida, petrol was hiked by 29 paise per litre to Rs 69.79 and diesel was hiked by 20 paise to Rs 61.93 as compared to 61.73 on Sunday.

In Gurugram, petrol prices increased to Rs 69.82 and diesel price rose to Rs 62.54.In Chennai, petrol costs Rs 71.07 per litre while diesel is at Rs 65.70 a litre. Whereas in Kolkata, petrol is at Rs 70.64 and diesel at Rs 64.01 a litre.

India Set To Replace UK As 5th Biggest Economy, But There Are Bumps

MMNN:5 January 2019

India's economy grew at a faster pace than most major nations in 2018, and this year, it's poised to overtake the UK to become the world's fifth-biggest.

But that journey won't be smooth. The outcome of a general election due by May is a potential pitfall for a nation already battered by emerging market turmoil and a currency rout last year. Also, any attempts by the government to undermine the central bank's freedom and raid its surplus capital may spook investors and carry damaging consequences for the economy.

Here are the key themes to watch for in 2019:

Global Slowdown

Nomura Holdings Inc. estimates global growth will ease to around 2.8 percent in 2019 from 3.2 percent in 2018, led by a slowdown in China, and a moderation in the U.S. and euro-area toward long-term trends. "As cyclical impulses become less favorable, we expect exports, manufacturing and the investment cycle to weaken" in India, Nomura analysts said.

Monetary Policy

After raising interest rates twice last year, 2019 may see the Reserve Bank of India reverse course by giving up its hawkish monetary policy bias in favor of a neutral stance. With demand slowing and oil prices easing, inflation is expected to average toward the RBI's medium-term target of 4 percent in the first quarter of 2019. The six-member monetary policy committee may even be in a position to lower interest rates in the first half of the year, according to some analysts.

Shaktikanta Das, the new central bank governor, is seen as more dovish on monetary policy, saying inflation is benign and supporting growth is part of the RBI's focus. His predecessor, Urjit Patel, who unexpectedly quit last month, took a more cautious approach on price growth.

Interest-rate cuts could give a boost to lending and growth before the general election.

Election Risks

With the world's biggest election around the corner, Prime Minister Narendra Modi is under pressure to boost spending, especially to help farmers, to shore up voter support and spur an economy that's starting to slow. Data for the three months through September showed growth eased to 7.1 percent from the 8-plus percent pace seen in the previous quarter.

Spending pressures intensified last month following disappointing results for PM Modi's Bharatiya Janata Party in state elections, and farm loan waivers announced by the opposition Congress party in three states it won from the BJP.

The government is said to be studying three options, including a cash handout for farmers, to ease the distress for farmers and to shore up popular support ahead of elections. It's already slashed taxes on some goods and services and announced exemptions on pension withdrawals to appease voters.

These are in addition to programs for guaranteed crop prices and healthcare, the full impact of which will be known only in the budget, due to be delivered on Feb. 1.

With the government already exceeding its budget deficit targets in October, any additional measures will need to be balanced with possible reductions in spending to meet the fiscal goal of 3.3 percent of gross domestic product for the year through March.

A loss for PM Modi in the general election is a risk in terms of policy continuity, and investors are watching the events closely.

Sonal Varma, chief India economist at Nomura Holdings Inc. in Singapore, expects the government to be in limbo until a new administration is in place in May, posing a drag on spending growth in the first half of 2019

Cabinet approves merger of Vijaya Bank, Dena Bank into Bank of Baroda

MMNN:3 January 2019

New Delhi, The Union Cabinet on Wednesday cleared the merger of Bank of Baroda, Vijaya Bank and Dena Bank.

The Bank of Baroda would be the transferee bank while Vijaya Bank and Dena Bank would be transferor banks, Union Minister Ravi Shankar Prasad told a press conference after the Cabinet meet.

Mr Prasad said the merger would come into force from new financial year April 1, 2019.

The Cabinet was held under the chairmanship of Prime Minister Narendra Modi here.

Jet Airways Defaults On Debt Payment To Banks, Shares Plummet Nearly 6%

MMNN:2 January 2019

Cash-strapped Jet Airways said late Tuesday it defaulted on debt payment to a consortium of banks, prompting ratings agency ICRA to downgrade the carrier and sending its shares sharply lower. The payment of interest and principal instalment was delayed "due to temporary cash flow mismatch", Jet said in a statement, adding that it was in talks with the consortium led by State Bank of India. The deadline for payment was Monday, December 31.

ICRA cut Jet's long- and short-term ratings on Wednesday, citing the payment delays.

Timely implementation of liquidity initiatives, including equity infusion and a stake sale in the airline's loyalty programme Jet Privilege, will be critical to the company's credit profile, ICRA said.

The 25-year-old airline is facing financial difficulties and owes money to pilots, lessors and vendors. Intense pricing competition, a weak rupee and rising fuel costs weighed on the country's airlines in 2018.

Jet, the country's biggest full-service carrier by market share, had a debt of Rs. 8,052 crore ($1.15 billion) as of September 30, 2018.

Jet and its second-largest shareholder, Etihad Airways, are in talks with bankers on a rescue deal that may involve the Abu Dhabi-based airline increasing its stake from 24 per cent at present.

The airline's shares declined as much as 5.84 per cent in their sharpest intraday drop in over three weeks and were last down 5.27 per cent at Rs. 266.00, as of 2:33 pm on the NSE.

SAIL must keep pace with new growing companies: Birender Singh

MMNN:29 December 2018

New Delhi, Times are changing and SAIL must keep pace with the new and fast growing steel companies, Union Steel Minister Chaudhary Birender Singh said on Friday.

Outlining four mantras for SAIL - Speed, Aggression, Innovation and Loyalty - the Minister said decisions, actions and projects need more speed and marketing.

He said new areas and markets like North-East need to be explored and technology, thinking and working has to be innovative and all this will happen only if those associated with SAIL have loyalty and commitment towards the company and country.

Mr Singh was addressing an event, organised to commemorate the 60 years of the SAIL foundation here.

The Minister exhorted SAIL to invest in research and development, technology development and production of high-grade, value-added steel as these are the priorities of the government and SAIL has a crucial role to play in all these areas.

"National Steel Policy, 2017 has set ambitious target of 300 MT steel capacity by 2030-31 and SAIL with 1/6th of the proposed capacity is going to be a key contributor. However, all this must be done in a systematic and planned way. Each plant and unit has to adopt the culture of 'Safety First'."

Stressing that the culture of safety has to be an integral part of the working, he said the Ministry will observe daylong of the year as Safety Day for the steel sector from 2019.

Minister of State for Steel Vishnu Deo Sai expressed hope that with its continued hard work, SAIL will be able to fulfill the right expectations of the country in future too.

The first furnace of Rourkela Steel Plant began functioning in 1959 setting the foundation for building India's economic development. SAIL nowadays is a Maharatna company and the largest steel producer and also the highest iron ore miner in India. Steel is a deregulated sector and SAIL operates in open economy producing 21.4 million tonnes steel per annum and contributing 1.5 times of India's GDP and 6.8 times to employment generation.

Steel Ministry Secretary Binoy Kumar and SAIL Chairman Anil Kumar Chaudhary and top officials of Ministry of Railways and other Central Government departments were also present on this occasion.

Suzuki Motorcycle India launches 2019 edition of its ultimate sportbike 'Hayabusa'

MMNN:28 December 2018

Mumbai, Suzuki Motorcycle India Private Limited (SMIPL), a subsidiary of two-wheeler manufacturer, Suzuki Motor Corporation, Japan, on Thursday launched the 2019 edition of the Hayabusa, one of the most iconic motorcycle in India. Suzuki Hayabusa will be available across all Suzuki Big Bike dealerships for Rs 13,74,364 (ex-showroom, Delhi).

The legendary Hayabusa enjoys wide base of loyalists and enthusiasts globally and is known for its high speed and sportiness.The 2019 edition of Suzuki Hayabusa will be offered in two new colour schemes- Metallic Oort Gray and Glass Sparkle Black- with updated graphics, and an added pair of side reflectors for Indian conditions.

Commenting on the launch of 2019 Suzuki Hayabusa, Mr Satoshi Uchida, Managing Director, SMIPL said, 'For 20 years, Suzuki Hayabusa has been one of the most loved sportsbike among the enthusiasts for almost two decades and has received an excellent response in India.

It is our constant endeavour to offer great products, and we are pleased to launch the 2019 edition of Hayabusa in two new colour schemes appealing to a larger fan base and enthusiasts in India.'

Suzuki Hayabusa is powered with 1340cm3 four stroke fuel injected liquid-cooled DOHC engine to deliver a broad wave of torque for effortless acceleration. The advanced aerodynamics add to superb wind protection both for normal and completely tucked-in seating.

Government Has Revival Plan For Air India, Says Jayant Sinha

MMNN:27 December 2018

NEW DELHI: The government has prepared a revival plan for Air India that provides for a comprehensive financial package, differentiated strategies for each of the airline's core businesses and robust organisational reforms, Union Minister Jayant Sinha said on Thursday. Various initiatives to turnaround the national carrier, which is staying afloat on a bailout package extended by the previous government, including monetisation of real estate assets are progressing. Mr Sinha told the Lok Sabha that the government has prepared a revival plan for Air India which focuses on building a competitive and profitable airline group.

A comprehensive financial package, including transfer of non-core debt and assets to a Special Purpose Vehicle, implementation of a robust organisational and governance reforms by the board and differentiated business strategies for each of the core businesses of Air India are part of the plan.

"Higher levels of operational efficiency by strengthening management and implementing best business processes," are among the major elements of the plan, Mr Sinha said. The minister of state for civil aviation also said that Air India has planned to monetise its unutilised and surplus immovable real estate assets over the next few years.

"Till date, Air India has realised an amount of Rs. 410 crore through sale of its non-core assets in various cities in India and abroad. "Air India has also realised a rental income of Rs. 314 crore approximately," he said during the Question Hour.

The minister also said that amount of revenue likely to be generated from monetisation of land and properties depends on the bid process and subject to no-objection certificates from authorities concerned. Air India is estimated to have a debt worth over Rs. 55,000 crore. In a written reply, Mr Sinha said the government remains committed to the disinvestment of Air India.

"In this regard, AISAM has directed to separately decide the contours of the mode of disposal of the subsidiaries -- Air India Engineering Services Ltd (AIESL), Air India Air Transport Services Ltd (AIATSL) and Airline Allied Services Ltd (AASL)," he noted. The Air India Specific Alternative Mechanism (AISAM) has also approved the contours for sale of subsidiaries of Air India and has directed to expedite the sale of AIATSL, the minister added.

Crude Oil Price Plunges 6% As Economic Slowdown Fears Grip Market

MMNN:25 December 2018

Crude oil prices plunged more than 6 per cent to the lowest level in more than a year on Monday, pulling back sharply late in the session as fears of an economic slowdown rattled the market.

US crude futures and global benchmark Brent hit their lowest levels since 2017 during the session, putting both benchmarks on track for losses of about 40 per cent in the fourth quarter.

"What's happening in the stock market is raising fears that the economy is grinding to a halt and thereby will basically kill any future oil demand," said Phil Flynn, an analyst at Price Futures Group in Chicago. "They're pricing in a slowdown in the economy if not a recession with this drop."

The fourth-quarter price decline is likely to cause producers to throttle back on their output, he said.

US crude futures have hit the lowest level since June 22, 2017, as jitters have grown about the impact of the escalating US-China trade dispute on global growth and crude demand. Brent crude is at its lowest level since August 17, 2017.

Markets across asset classes have come under pressure as the US government shutdown that began just after midnight on Saturday intensified growth concerns. Investors have flocked to safe-haven assets such as gold and government debt at the expense of crude oil and stocks.

A gauge of stocks worldwide hurtled toward an eighth straight decline on Monday as investors ignored the US Treasury secretary's actions to reinforce confidence in the economy and US President Donald Trump criticized the Federal Reserve as "the only problem our economy has".

The US Senate has been unable to break an impasse over Mr Trump's demand for more funds for a wall on the border with Mexico, and a senior official said the shutdown could continue until January 3.

US crude futures settled at $42.53 a barrel, down $3.06, or 6.7 per cent. Brent crude futures settled down $3.35, or 6.2 per cent, at $50.47 a barrel. The market settled early ahead of the Christmas holiday. Prices extended losses in post-settlement trade.

Brent fell 11 per cent last week and hit its lowest level since September 2017, while US futures slid to their lowest level since July 2017, bringing the decline in the two contracts to more than 35 per cent for the quarter.

The macroeconomic picture and its impact on oil demand continue to pressure prices. Global equities have fallen nearly 9.5 per cent so far in December, their biggest one-month slide since September 2011, when the euro-zone debt crisis was unfolding.

The US-China trade dispute and the prospect of a rapid rise in US interest rates have brought global stocks down from this year's record highs and ignited concern that oil demand will be insufficient to soak up any excess supply.

The Organization of the Petroleum Exporting Countries and allies led by Russia agreed this month to cut oil production by 1.2 million barrels per day from January.

Should that fail to balance the market, OPEC and its allies will hold an extraordinary meeting, United Arab Emirates Energy Minister Suhail al-Mazrouei said on Sunday.

COMMENT

"Oil ministers are already taking to the airwaves with a 'price stability at all cost' mantra," said Stephen Innes, head of trading for Asia-Pacific at futures brokerage Oanda in Singapore.

Fuel prices dip again; petrol costs Rs 75.97 p/l in Delhi

MMNN:23 November 2018

New Delhi, Fuel prices witnessed a dip again on Thursday as the rates were slashed up to 43 paise per litre on Thursday, owing to a reduction in the rates of crude oil in the global market.

The petrol price was reduced by 40 to 43 paise per litre in all four metro cities, while diesel has witnessed a dip of 30 to 48 paise per litre.Petrol in Delhi is retailing at Rs 75. 97 per litre, while diesel costs Rs 70.97 per litre.

In Mumbai, petrol is being sold at Rs 81. 50 per litre and diesel at Rs 74.34 litre.

In Chennai and Kolkata petrol after the revision of price costs Rs 78.88 per litre and Rs 79.31 per litre respectively.

Diesel in Kolkata was Rs 72.83 per litre, a cut of 30 paise and in Chennai is is being sold at Rs 74.99 per litre, a slash of 32 paise.

Fuel prices registers no change on Wednesday;remains the same

MMNN:22 November 2018

New Delhi, Fuel prices remained the same on Wednesday after consecutive fall for six days.

According to the Indian Oil Corp data, petrol was priced at Rs 76.38 per litre in the national capital.

In Mumbai, petrol is retailing at Rs 81.90 per litre, Rs 78.33 in Kolkata and Rs 79.31 in Chennai.

Diesel too remained unchanged across the four metros. In Delhi, diesel is selling at Rs 71.27 per litre. Similarly, prices of diesel in Mumbai was at Rs 74.66 per litre, in Kolkata and Chennai prices were declined to Rs 73.13 and Rs 75.31 a litre respectively.

The 4 Reddy Sisters Running $2 Billion Apollo Empire

MMNN:21 November 2018

Next to Suneeta Reddy's desk in the executive suite of Apollo Hospitals Enterprise Ltd. hangs an icon of goddess Durga, who Reddy prays to each morning. The deity's presence seems fitting at a company run by four women engineering an aggressive expansion into new territory. About a decade ago, Reddy and her three sisters took over most executive functions at Apollo, the country's largest hospital chain, from their father. They embarked on a multi-year building spree in a bet that the economic growth would spread from its metropolises to second-tier cities, where patients are getting richer. But Apollo's stock tumbled as the sisters' investments weighed on profits.

Now, almost Rs. 2,000 crore ($280 million) and four years of construction later, there are signs that strategy is about to pay off. All those hospitals are built. Analysts are predicting that annual earnings are poised to climb for the first time since 2015. Apollo's shares have gained about 30 per cent after hitting a four-year low in June, and stock forecasters are more bullish than they have been in a decade.

The four of us recognized there was a demand and supply gap, and we needed to fill it," Reddy, 59, who holds the title of co-managing director, said in an interview this month in Chennai. "The capacity to pay more will exist."

The company's stock climbed as much as 2.5 per cent in Mumbai before trading 1.9 per cent higher at Rs. 1,215.70 at 11:51 a.m in Mumbai, reversing three days of declines on a day when the broader market was down.

Tackling Hurdles

Health-care is becoming one of the largest businesses, with the size of the hospital industry projected to more than double to $133 billion over the next four years, according to the government's India Brand Equity Foundation. Most patients pay health costs out of pocket, but incomes are rising and the insurance industry is developing. More citizens could be insured over the coming decades as Prime Minister Narendra Modi's government expands a new initiative to provide health insurance for the poorer half of the country's population

Yet, even as Apollo's expansion has offered fresh opportunities, it's also brought the sisters new challenges. Despite signs that investors are coming around, expenditures from the sisters' big build have left the stock and profits well below their peaks, and debt has more than doubled over the past four years.

There are other hurdles that have the potential to hamper growth if Apollo doesn't get its formula right. Convincing an internationally trained surgeon to relocate to Mumbai is hard enough, never mind inland to a small city. Also, Apollo found that people in smaller cities aren't always willing to pay as much, a hurdle for a model of premium prices for premium care. Competition is also growing with more hospitals jostling for a slice of the market.

And Reddy doesn't expect an immediate effect from the government's new insurance program. While Apollo plans to allocate beds for the programme, it won't turn a profit on those patients because those facilities are set up to cater to the high end of the market, she said. The company is starting to conduct experiments in lower cost care in suburban Chennai such as paying doctors fixed salaries rather than for individual services and substituting generic drugs for brands.

Reddy said Apollo is digging deeper into the pool of domestically trained doctors, and developing detailed protocols to ensure smaller centers follow uniform practices. And it's become more "flexible" about pricing to establish itself in new communities, she said.

She predicts occupancy at newer hospitals will gradually increase to the 70 per cent level seen in established ones. The company also predicts that profit margins at the new hospitals will approach the 20 per cent level from around 6 per cent now.

"They seem to be getting their calculations right in terms of their return expectations," Rakesh Nayudu, an equity analyst for Haitong Securities India. "They're targeting the right cities." Of the 23 analysts that cover the company, 21 recommend buying the stock.

Reddy's father Prathap, a doctor, founded Apollo in 1983 after a patient of his died because a cutting-edge treatment wasn't available in India. Apollo now has a market value of $2 billion, annual revenue of $1 billion, internationally-trained doctors, operating theatres with the latest equipment. Patients can choose to recuperate in suites with a living room and two bathrooms. The family still owns 34 per cent of the company.

Prathap Reddy remains chairman at age 86, with two of the sisters, Preetha Reddy and Shobana Kamineni, acting as co-vice chairs. Suneeta and Sangita Reddy share the title of managing director, typically the equivalent of the CEO role in corporate India.

There are also the tricky questions around succession that will have to be managed. When their father relinquishes his role, the plan is for the eldest sister Preetha to succeed him, though strategy would still be decided by a vote between the four sisters, Suneeta Reddy said.

Having all four of them on the 10-person board means the company has four times as many women as the average domestic board, and more on average than major companies in the US and the UK. Reddy says their cohesiveness comes down to a clear division of labour that plays to each one's strengths.

"It's because we're sisters that we're able to weave it together," Reddy said. "I think if the chairman had four sons they probably would have created four companies to do it."

Prabhu launches AirSewa 2.0; says improving service quality is on priority

MMNN:20 November 2018

New Delhi, Union Civil Aviation Minister Suresh Prabhu on Monday said the focus is on improving the quality of services so that passengers who are travelling have a safe and comfortable experience.

He said a need was felt for development of an upgraded version of AirSewa to provide a superior user experience with enhanced functionalities. Major improvements include features such as secure sign-up and log-in with social media, chatbot for travellers support, improved grievance management such as social media grievances, real-time flight status and details flight schedule.

Mr Prabhu said this after launching the upgraded version of AirSewa 2.0 web portal and mobile app here along with Minister of State for Civil Aviation Jayant Sinha.Mr Prabhu said the upgrade and improved version of AirSewa will offer passengers a convenient and hassle-free air travel experience. The web portal and application will help to capture air travellers' feedback for policy interventions.

Speaking on the occasion, Mr Sinha said today, five crore passengers have been travelling every year and would grow exponentially in the near future. There was an urgent need of upgrading AirSewa and systemic intervention in improving customer services.

Air passengers, he said, face issues like flight delays, problem in refunds, long queues, inadequate facilities at airports and complaints of lost baggage and his Ministry launched AirSewa web portal and mobile app in November 2016 to address this need.

The AirSewa 1.0 was received well, with around 30,000 app downloads and around 75,000 web portal hits since its launch. It has helped significant number of air passengers to get their concerns resolved with 92 per cent closure rate for grievance solutions. In addition to grievance redressal, AirSewa also provides real-time flight status and flight schedules, he added.

The junior Minister said further upgrades of AirSewa are also being planned which would include DigiYatra registration, airport maps, BHIM payment integration and grievance escalation and transfer.

The two Ministers also gave away the champion award to Chennai airport which saw 100 per cent timely closure of grievances in one year.

RBI Board, Govt meeting underway to solve rifts

MMNN:19 November 2018

New Delhi/Mumbai, A crucial meeting of the Reserve Bank of India and the Government is underway on Monday to draft new prompt corrective actions for weak lenders amid increasing non-performing assets and bad loans, providing liquidity to non-banking financing companies and new capital guidelines for the central bank.

The RBI Board of Directors include five full time members - RBI Governor Urjit Patel, Deputy Governors N S Vishwanathan, Viral V Acharya, B P Kanungo and Mahesh K Jain.

The Government has inducted Department of Economic Affairs Secretary S C Garg and Department of Financial Services Rajiv Kumar into the Board as its representative. The Board has also 11 independent directors.

The meeting is also expected to take up issues of resolving liquidity crunch to lend sufficient capital to non-banking finance companies in wake of IL&FS defaults.

It may also frame new prompt corrective actions (PCA) for weak banks amid growing bad loans in order to make them stable and stand on their own feet.

The meeting is likely to also discuss the issue that there should be sufficient capital and easier norms for small and medium businesses.The issue of RBI reserve surplus is also expected to surface in the meeting of which the Central Bank is not in favour.

Besides, sources say the government has recommended that the RBI Board frame rules and regulations such as financial stability and monetary policy transmission. However, the Bank wants that these regulations should be draft by experts only.

NDA govt has influenced aspirations of low-income people: Jaitley

MMNN:16 November 2018

New Delhi, The NDA Government's achievement in financial inclusion have in a way influence the aspirations of low-income population, leading to improve lives in rural areas, Union Finance Minister Arun Jaitley said on Thursday.

Mr Jaitley said the government in just four years has achieved remarkable results as it has opened numerous bank accounts under the Jan Dhan Yojna, providing funds to Start-Ups and covered the rural areas.

"Within a short span of time, what started of as a financial inclusion experiment, we have been able to achieve remarkable results in banking the unbanked, securing the unsecured, funding the unfunded and covering the uncovered rural areas. Our achievements in financial inclusion have in a way influenced the aspirations of the low-income population. This has led to improving the rural sanitation, providing better quality of life to poorer population in the villages," the Minister added.

The Finance Minister said the subject of digital financial inclusion is a topic of extreme importance to a country like India where they have adopted a higher growth rate to propel development.

He was speaking at the 25th World Congress of Savings and Retail Banks organised here.

NABARD chairman Dr Harsh Kumar Bhanwala said the financial inclusion model adopted by India has contributed to inclusive growth and laying down a huge digital infrastructure which can be used by state governments for providing various benefits to the poorer population.

He said the NABARD has also enabled outreach to more than 100 million rural women through partnerships with over 60,000 bank branches and over 5,000 civil society organisations. Savings plays a very critical role in all the financial inclusion approaches promoted by NABARD.

Mr Bhanwala said NABARD is also in the process of digitisation of self-help groups, which contributes to intensification of credit, convergence of various government benefit schemes and providing better business opportunities for banks with over 100 million members of SHGs.

Speaking on the occasion, outgoing WSBI President Heinrich Haasis provided a summary of achievements made during his six-year association presidency, including inroads made toward a WSBI pledge to provide "an account for everybody", which was outlined in a 2012 WSBI declaration in Marrakesh.

"Since our World Bank Universal Financial Access 2020 commitment made in 2015, WSBI members have added 340 million accounts for 234 million people into the formal financial system thanks to their efforts," he added.

Department of Financial Services Secretary Rajiv Kumar was also present on the occasion

Jet Airways Surges 26% On Reports Of Tata Pursuing Controlling Stake

MMNN:15 November 2018

Jet Airways shares jumped as much as 29.93 per cent on the Bombay Stock Exchange (BSE), before closing 24.52 per cent or Rs. 63.20 higher at 320.95, on Thursday. The surge in Jet Airways share price came after reports emerged that Tata Sons is in pursuit of a controlling stake in the debt-laden carrier. Jet Airways share price rose by as much as Rs. 77.15 to touch Rs. 334.90 at the day's strongest point, from the previous close of Rs. 257.75.

On the National Stock Exchange (NSE), Jet Airways shares closed at Rs. 326 apiece, a rise of Rs. 68.10 or 26.41 per cent against a 0.38 per cent rise in benchmark index Nifty. Jet Airways share price surged by as much as Rs. 77.1 to touch an intraday high of Rs. 335 on the NSE, from their previous day's close of Rs. 257.90.

On Wednesday, news agency Reuters, citing people aware of the talks, reported that Tata is weighing up the economic viability of a deal which would make it Jet Airways' decision-maker, necessitating the departure of the airline's founder, Naresh Goyal. "There are compelling reasons but any deal with Jet is opportunistic," one of the people said. "Tata needs to see if it fits into its overall aviation strategy."

Tata Sons is the holding company for Tata Group which already has two aviation ventures in India - Vistara with Singapore Airlines, and AirAsia India with Malaysian carrier AirAsia Group. Jet Airways chairman Mr Goyal is the majority owner of the airline in which Etihad Airlines also owns a stake. The struggling airline has also not been able to pay salaries to the employees on time.

Earlier, Jet Airways posted its third straight quarterly loss at Rs. 1,297 crore for the quarter that ended September.

Wholesale Inflation Surges To Four-Month High In October

MMNN:14 November 2018

Wholesale inflation - based on the Wholesale Price Index (WPI) - accelerated to a provisional 5.28 per cent in October from 5.13 per cent in September, and 3.68 per cent in October 2017, government data showed on Wednesday. The wholesale or headline inflation reading of 5.28 per cent marked the highest level recorded in four months. The Central Statistics Office (CSO), under the Ministry Of Commerce & Industry, had last reported a higher inflation at 5.68 per cent in in June this year.

The rate of price increase in manufactured products, which has the maximum weightage (more than 64 per cent) on the Wholesale Price Index, stood at 4.49 per cent in October, the CSO said in its official release. The index for manufactured products comprises items such as food products, beverages, chemicals, metal goods, machinery and electricity.

Wholesale inflation in primary articles, including food articles (cereals, paddy, onions, milk etc.) and petroleum items (crude and natural gas), was at 1.79 per cent in October. The index for primary articles has the second highest weightage of 22.6 per cent on the WPI.

Petrol, diesel and liquefied petroleum gas (LPG) or cooking gas, which form a part of the fuel and power basket, registered a rise of 19.85 per cent, 23.91 per cent and 31.39 per cent respectively. Inflation in the 'fuel and power' basket in October spiked to 18.44 per cent, from 16.65 per cent in September.

The uptick in the WPI inflation in October 2018 reflected the impact of the pass through of higher commodity prices and the INR depreciation, whereas the disinflation in food prices had a much smaller impact on wholesale inflation than the CPI (consumer price index), given the difference in weights for food items in the two indices," said Aditi Nayar, Principal Economist, ICRA Ltd.

Wholesale prices of food articles, vegetables, pulses and onion witnessed a deflation of 1.49 per cent, 18.65 per cent, 13.92 per cent, and 31.69 per cent respectively.

Earlier this week, official data showed that retail inflation eased to a 13-month low of 3.31 per cent in October. This was a third straight month in which consumer inflation remained below the central bank's medium-term target of 4 per cent. The Reserve Bank of India takes into account consumer inflation while determining the monetary policy.

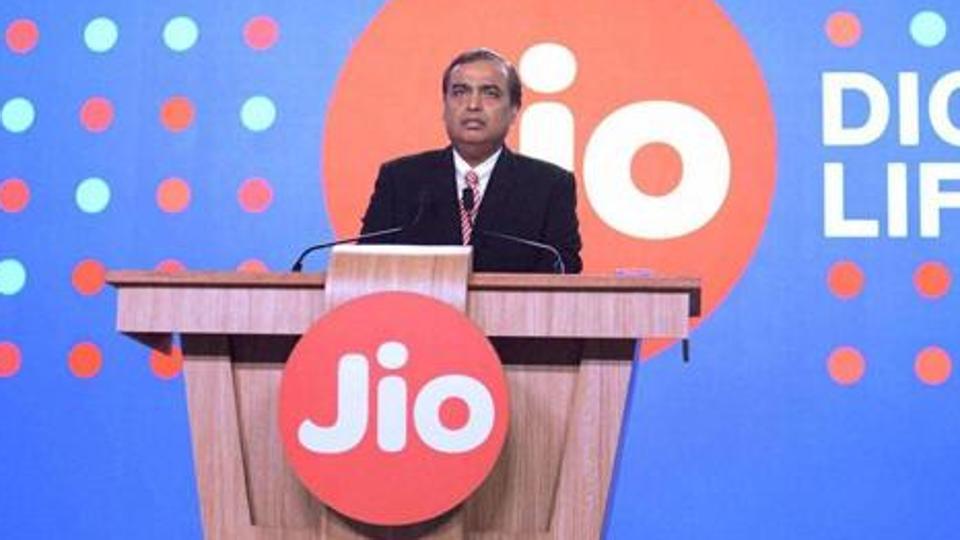

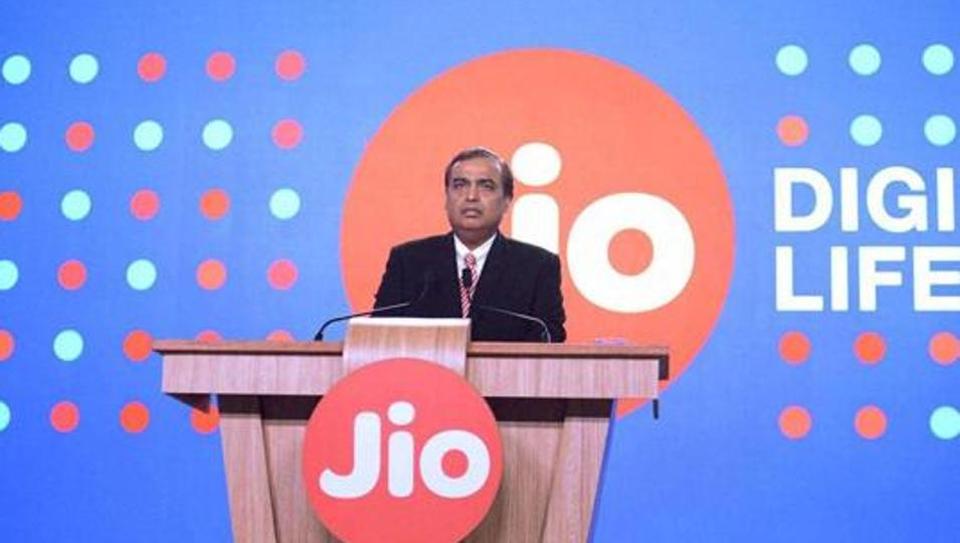

Reliance to create world's largest online-to-offline New Commerce Platform- Mukesh Ambani

MMNN:13 November 2018

Bhubaneswar, Reliance is working on creating the world's largest online-to-offline New Commerce Platform and transforming the lives and businesses of three crore merchants and small shopkeepers in the country,Chairman and Managing Director Reliance Industries Limited Mukesh D Ambani said.

"We will enable them to do everything that large enterprises and large ecommerce players are able to do", Mr Ambani said while addressing the Make in Odisha Conclave here today.

"I can assure you that Reliance and Jio will considerably improve the Ease of Living of each and every citizen of India, and also improve the Ease of Doing Business for Odisha's small and medium enterprises", he said.

Mr Ambani said Prime Minister Narendra Modi's inspiring vision of Digital India is to make India a leader in the digital economy globally adding that today, India is the fastest digitizing economy in the whole world.

Stating that Jio is leading India's digital transformation, he said since Jio commenced operations a little over two years ago, India has moved from the 155th rank in mobile broadband penetration to being the number one nation in mobile data consumption in the world.

With JioGigaFiber, Mr Ambani said, "We have now begun an ambitious push in the fixed broadband through Fiber-to-the-home and Fiber-to-the-premises and our aim and resolve is to ensure that India rises from the present 135th rank to be among the top three nations in fixed broadband in the next three years'.

Mr Ambani said, "I have a big reason for focusing on the digital business.The world is at the cusp of a digital revolution. Everything in the world is going digital - music, movies, commerce, banking, cars, homes, healthcare, education - every aspect of life is going digital'.

Digital technologies will completely transform every sector of the economy, and every field of life and this will be achieved by using the most powerful tool of our times.the tools of connectivity and digital technologies. New generation digital technologies, with Artificial Intelligence at their core, are rapidly transforming our world like never before in world history, he added.

India still 27 positions away from its target, says Jaitley

MMNN:2 November 2018

New Delhi, India is still 27 positions away from target, set by the NDA government that New Delhi should be amongst the first 50 nations in the 'Ease of Doing Business', Union Finance Minister Arun Jaitley said on Thursday.

Mr Jaitley said when the NDA took the regime in 2014 that, the Narendra Modi government's objective was to ensure that India should be amongst the first 50 nations in the 'Ease of Doing Business'. His call seemed to be a tall promise since India was on 142 rank and had to move up 92 positions.

The Minister said this in his blog 'India and the Ease of Doing Business',posted on the social media. The Government started working on each of the criteria in 2014 itself. Announcement of a change, a legislation or a policy is not enough unless the effect of the same is felt on the ground. The World Bank doesn't regard announcements as a worthy improvement. There is always a timeline between the reform and the upgrade, he added.

Mr Jaitley said: "Having inherited the legacy of position No142, we moved up, in the first two years, and retained position No 130. In the third year, we have made a major jump of 30 positions to reach position No 100 and in the fourth year, we have moved to position No 77. This is a 65 point improvement in the first four years. We are still 27 positions away from the target. The impossible now looks plausible."