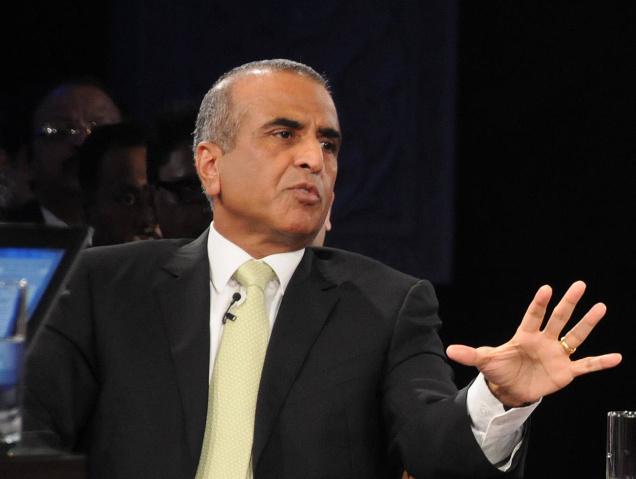

Govt should make available more spectrum: Mittal

Our Correspondent : 8 Nov 2014, Bhopal

Bharti group Chairman Sunil Mittal on Thursday said the telecom industry wants more spectrum and the government should make it available.

“We want from the government more spectrum. Every country has the same amount of spectrum and it is not that India has less... It needs to be vacated from other places, that is what other countries have also done,” Mr. Mittal said on the sidelines of the India Economic Summit in New Delhi.

Telecom Regulatory Authority of India, on October 15, gave its recommendation on spectrum auction for premium 900 Mhz band and 1800 Mhz band that are presently being used for 2G GSM mobile services by Airtel, Vodafone, Idea Cellular and Reliance Communications.

Government has proposed to put for auction about 184 Mhz of spectrum in 900 Mhz band which is held by these companies through their various licences expiring in 2015-16. The four telecom operators will have to buy spectrum afresh to continue their services.

“I would say government should make available enough spectrum so that there is a balance between spectrum pricing” he added.

On being asked if the spectrum auction — scheduled for February 3 — should be deferred, Mr. Mittal said: “Why should this be deferred. Industry wants more spectrum and the government should make it available to them.”

On Bharti Airtel calling off the Rs 700-crore deal to acquire business and assets of Mumbai-based Loop Mobile, he said much is being read into this.

“Loop mobile is a small issue and I don’t know why this is being made into such a big issue. Most of the Loop subscribers have ported to us. It was a small deal, which was basically an experiment for the first time to acquire customers. Its not about the merger but about the renewal of the agreement,” Mr. Mittal said.

Airtel, in a filing to BSE, had said its proposed transaction related to Loop was conditional upon DoT approvals which had not been received till date.

DoT is yet to give clearance to the proposed deal as it estimates that Loop Mobile and its sister concern Loop Telecom owe about Rs 808 crore in spectrum and other charges to the government.

Private sector lender Axis Bank has also told the DoT that Rs 215-crore loan to Loop Mobile will be at risk if the deal of the Mumbai-based operator to sell its assets to Bharti Airtel is not approved.

Airtel had signed the deal with Loop in February this year to buy business and assets of Loop Mobile in Mumbai under a strategic agreement for about Rs 700 crore.

Under the agreement, Loop Mobile’s 3 million subscribers (at that time) in Mumbai were supposed to join Airtel’s over 4 million subscribers, which would have made it the largest network in the metropolitan city.

Monetary Policy Has Limitations in Addressing Issues and Unconventional Methods Need To Be Thought Of” – RBI Dy Governor

Our Correspondent : 08 Nov 2014, Bhopal

“Monetary Policy Has Limitations in Addressing Issues and Unconventional Methods Need To Be Thought Of” – RBI Dy Governor

“In Terms Of Corporate Leverage, India Ranks High With 83%” – RBI Dy Governor

“VUCA Has Become A New Normal” – RBI Dy Governor

“DNA of CFO’s Role Undergoing Mutation in the VUCA Environment” – V S Parthasarthy

CII-KPMG “Playing to Win in a VUCA Environment” Report Released

H R Khan, Deputy Governor, Reserve Bank of India (RBI), Chief Guest at the CII CFO Summit while delivering his address reiterated the outcome of the Global financial stability report of IMF which talked about risk with low volatility and risk arising out of quantitative easing. He mentioned that the measures like quantitative easing were meant to take the economic risk but have taken up financial risk.

Further he mentioned that with the global economic situation and the geopolitical uncertainty with outbreak of ebola, crisis in the Middle East & Ukraine and ending of US fed easing programme with uncertainty on the interest rate cycle; we can look at VUCA as Seriously Hyper and Accessible VUCA. He mentioned he would rather call it surviving and succeeding in the VUCA world, as it is a challenge for us all. VUCA demands stake holders to adapt to changes arising from growth opportunities, technology transformation and disruptive business models. He also quoted Friedman’s 3 eras of globalization and said how VUCA has become a new normal.

Speaking about monetary policy he mentioned that, today many countries don’t have fiscal space and are overburdened with deficits and the burden has come on to monetary authority and the authorities across countries followed accommodation policies. Today US is stopping the easing, whereas Europe and Japan have allowed further expansion. With tepid demand and structural impediments also arise other down side risk besides the fed rate hike, the speed and pace of the same needs to be looked at concern of possible hard landing by China, geopolitical tension and massive out breaks like ebola and large scale cyber-attacks are some of the risk. Monetary policy has limitations in addressing such issues and unconventional methods need to be thought of.

On the domestic front, the growth recovery is tepid but the growth sentiments are good. Capital and investment cycle are yet to pick up. Since we are coupled with global economy we can’t be insulated by global uncertainty. Going forward inflation still has a long way to go with rural inflation still being high.

On the corporate side increase of leverage is an issue, the June 2014 report of RBI has shown that the leverage by corporates has gone up; India ranks high with 83% of corporate leverage and sound hedging policies are advisable to corporates going forward, he added.

He concluded by saying, while looking at economy we need to look at the 7 C’s which are commerce, commodity prices, capital flows, confidence index, credit rating agencies & currencies, central bank actions & communications and consumer threats.

V S Parthasarathy, Chairman – CII CFO Summit 2014 and Chief Financial Officer & Group CIO

Mahindra & Mahindra Ltd, speaking about the summit objective said that the CFOs are in a make or break situation, with the DNA of CFO’s role undergoing mutation in the VUCA environment. A CFO can win in this VUCA world if they adapt to EEE i.e., Enable, Enhance and Engender as preparedness is the key. CFO who acts as the change happens will be a winner. He asserted that CFO version 1.0 was a simple bean counter. In version 3.0 he evolved into business partner and version 5.0, the CFO is a value creator.

Vivek Varun Prasad, IRS, Chief Commissioner of Income Tax – III, Mumbai mentioned that over last 2 decades the Tax department has always strived to make process simpler, responsive, transparent, efficient and effective for tax payers. Adding that the department witnessed 2.96 crores of returns filed online in 2013-14 over the 3.62 lakh returns filed online during 2006-07. Speaking about the new regulations he added that it is a continuous learning for providing better facilities to taxpayers.

He further shared that globally governments suffered drop in taxes due to slowing domestic economy, resultant to cuts in providing opportunity to pay less taxes which harmed everybody. He also highlighted that the OECD released a 15 step action plan to avoid tax avoidance and double norm taxation in 2013. Under which it recognized 3 popular mechanisms like hybrid mismatches, special purpose entities and transfer pricing.

Speaking about GAAR, he said that the new government has expressed to provide stable tax regime for economic development. GAAR was introduced by the finance act. The present GAAR puts burden of proof on tax authorities to prove arrangements that has been undertaken for both for purpose of tax avoidance. He added that fine tuning is underway to address the ambiguities arising under which the process of renegotiation of certain tax treaties to specifically include anti-tax abuse provision like limitation of benefit rules and beneficial ownership clauses are included.

R Mukundan, Immediate Past Chairman, CII Western Region and Managing Director, Tata Chemicals Ltd, in his opening remarks mentioned that economic sustainability alone is not a sufficient condition for the overall sustainability of an organization. Recent public statements of organizational strategies routinely contain commitments to social and environmental objectives in addition to the traditional financial ones. This evolution of corporate consciousness can be attributed to increased societal awareness and consequent public policy initiatives. Welcoming the audience he mentioned that the CII CFO Summit is an attempt to bring together a diverse cross section of opinions, views and ideas, inherent to the CFOs of the industry, as it prepares an action plan to address the challenges finance function faces, in a collaborative manner.

Richard Rekhy, Chief Executive Officer, KPMG in India speaking about the CII-KPMG report released at the summit said that for a CFO to understand all the risk he needs to have a robust risk management system. He added that the report highlights CFO as a catalyst of growth, a goal keeper who balances growth & risk and as transformation agent. The report also dwells on new regulations and analyzes if the CFO’s are ready to take on the new regulations and keeping their CEO’s on top of these regulations.

Punit Shah, Head - West, KPMG in India: “With the ongoing processes and ever changing policies, volatility, uncertainty, complexity and ambiguity (VUCA), have become the ‘new normal’. There is increasing pressure for the CFO from the shareholders to maximise returns by optimising taxes and increase earnings per share, while in doing so they have to ensure that they are not branded as villains for tax avoidance or tax evasion. They also have to safeguard that any corporate action does not bring any disrepute and negative publicity to the corporate image or brand. This report titled – ‘Playing to win in a VUCA environment’ focusses on the dual role CFOs today have to play which includes meeting the expectations of the CEO as well as running the growth agenda, enhanced governance, managing ever changing stakeholder expectations, and last but not the least, tax and regulatory changes and related uncertainties.”

Tata Motors bags orders for 928 buses under JnNURM scheme in South India

Our Correspondent : 14 Oct 2014, Bhopal

Tata Motors on Tuesday said it has received another order to supply 928 Tata Marcopolo built buses to the State Transport Authorities in South India.The order comprises 487 units bagged from Karnataka (Karnataka State Road Transport Corporation), 40 units from Puducherry (Pondicherry Road Transport Corporation), 97 from Kerala (Kerala State Road Transport Corporation) and 304 from North East Karnataka region (North Eastern Karnataka Road Transport Corporation), Tata Motors said in a press release.

These are part of the 2700 orders bagged by Tata Motors, for Tata 'URBAN' buses under JnNURM - II scheme, it added. The company said the 'URBAN' buses from Tata Motors with a smart new front fascia, have been designed for safety, comfort and convenience of passengers and better operating efficiency for State Transport Authorities.

It said these buses are fitted with CCTV cameras that can record every movement inside the bus, adding that wider passage-way for free movement, wider window panes for better visibility along with wider and lower entry/exit doors make these new buses "safe and convenient for commuters to enjoy public transportation".

Stating that these buses also enhance the operational efficiency for State Transport Units (STU's), the release said they are compatible to hook-up with a central control room server.

This enables an operator to monitor the performance of each bus in terms of number of trips, off-road position and adherence to pre-scheduled maintenance by monitoring real-time health of the bus through OBD (on-board diagnostics).

SEBI finds former Tata Finance MD guilty of illegal transactions in stocks of four firms including Infosys

Our Correspondent : 14 Oct 2014, Bhopal

In a high-profile case dating back to over 12 years, SEBI has found former Tata Finance Managing Director Dilip Pendse had executed "illegal transactions" in STOCKS of four firms including Infosys and erstwhile Telco.

The latest order, which has been passed after years of probe and various directions issued by SEBI itself and the Securities Appellate Tribunal in between, prohibits Pendse from accessing capital markets for two years.

While the present order, passed on Monday, comes into effect immediately, SEBI said that the period of prohibition already undergone by Pendse (imposed by an earlier order dated December 24, 2012) would be taken into account while implementing the new directive.

Amid a public spat between him and the Tata group, Pendse was removed as Tata Finance chief way back in 2001 after a company subsidiary ran huge mark-to-market losses and the group also filed criminal charges against him. While Pendse refuted all charges, which included those related to fraud, he also had to spend time in jail.

SEBI has passed the latest order after the Securities Appellate Tribunal (SAT) quashed SEBI's December 24, 2012 directive against Pendse and asked the regulator to pass a fresh order "on merits and in accordance with law as expeditiously as possible and in any event within a period of six months". The SAT gave these directions on April 16, 2014.

Giving the background of the case, SEBI said it began its probe after receipt of a complaint in October 2002 from Tata Finance about Pendse conducting "illegal carry forward transactions in the scrips of Himachal Futuristic Communications Ltd (HFCL), Tata Engineering and Locomotive Company Ltd (presently known as Tata Motors), Infosys and Software Solutions India Ltd (SSI).

These illegal transactions were conducted by Pendse in complicity with two BROKERS -- Jhunjhunwala Stockbrokers Pvt Ltd and Pratik Stock Vision -- and on behalf of Inshaallah Investments, in which a Tata Finance subsidiary (Niskalp Investment and Trading) had a vital interest, according to SEBI.

After investigating the case, SEBI issued a show-cause notice in April 2009 to Pendse, citing violations to its Prohibition of Fraudulent and Unfair TRADE Practices Regulations. An order was passed by SEBI subsequently on December 24, 2012, which was challenged by Pendse before SAT.

Following SAT's directions earlier this year, SEBI said, it gave an opportunity of personal hearing to Pendse and has passed the latest order after looking into all the facts of the case and submissions made before it.

SEBI ruled that Pendse has violated various provisions of the PFUTP Regulations and the Securities Contracts Regulation Act with his illegal transactions in scrips of HFCL, Telco, Infosys and SSI.

PepsiCo India posts double digit growth in revenue

Our Correspondent : 13 Oct 2014, Bhopal

PepsiCo India's revenue grew in double digits for nine months ended September 6, 2014 making the country amongst the fastest growing emerging MARKETS for the global beverages and snack giant.

"Our developing and emerging MARKETS business has proven to be resilient with high single-digit organic revenue growth year-to-date, including double-digit growth in Egypt and India," PepsiCo Inc Chairman and CEO Indra Nooyi said in an earnings call. "Even though the political environments are relatively stable, GDP and consumer spending growth remains mixed. Despite these challenges, our businesses performed well in the third quarter and year-to-date," she added.

Other developing MARKETS for the company such as China, Brazil and Turkey recorded high single digit growth while revenue in Russia grew in mid single-digit.

Ads by Plus-HD-V1.5c×During the third quarter ended September 6, 2014 PepsiCo's Asia Middle East and Africa (AMEA) region reported 11% in organic revenue and net revenue. It was driven by 11% volume growth in snacks and 3% volume growth in beverages. Globally, PepsiCo reported organic revenue growth of 3.1% and net revenue growth of 2% in the third quarter.

PepsiCo has termed India as "high priority MARKET". In November 2013, PepsiCo said it will INVEST Rs 33,000 crore in India by 2020 to ramp up operations. The company said the INVESTMENT will be utilised to strengthen its capability in various strategic areas including innovation, manufacturing, infrastructure and agriculture.

India has been one of the top five markets of PepsiCo and it has eight brands which clock turnover of over Rs 1,000 crore in the market. The company has 42 plants across India and apart from cold drinks like Pepsi, 7UP, Mirinda and Mountain Dew, it sells snacks under brands such as Lehar, Uncle Chipps and Kurkure.

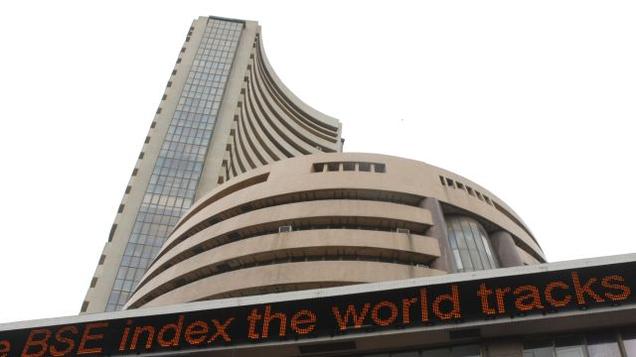

Market Report: Sensex falls 159 points in early trade

Our Correspondent : 13 Oct 2014, Bhopal

The benchmark BSE Sensex fell over 159 points in early trade on Monday on continued capital outflows by foreign funds and selling by retail investors after industrial production growth slowed to five-month low in August amid a weak trend overseas.

The 30-share barometer declined by 159.35 points, or 0.61%, to 26,138.03 with realty, metal, auto, capital goods and banking stocks, leading the fall.

The index had plunged 339.90 points in the previous session on Friday.

On similar lines, the National Stock Exchange index Nifty moved down by 52.00 points, or 0.66%, to trade at 7,807.95.

Brokers said selling activity gathered momentum on disappointing economic data as the country's industrial production growth slowed to five-month low of 0.4% in August.

Besides, a cautious approach by participants ahead of quarterly earnings of bluechip company RIL, to be announced after market hours on Monday and a weak trend in other Asian markets, influenced trading sentiments in Mumbai. Stocks of RIL were down 0.72% to Rs 953.40.

Among other Asian markets, Hong Kong's Hang Seng index was down by 0.89%, while Japan's financial markets are closed today for a public holiday.The US Dow Jones Industrial Average ended 0.69% lower in Friday's trade.

Maruti Suzuki CEO Kenichi Ayukawa says entering new segments will be challenging

Our Correspondent : 13 Oct 2014, Bhopal

Maruti Suzuki, the biggest carmaker in India, is gearing up to enter newer segments next year. Kenichi Ayukawa, managing director and CEO, in a recent interaction said it is going to be equally challenging for the company to establish itself in the uncharted territory.

"I think next year is going to a year of new segments, said Ayukawa, while talking to dna. Known for its compact and entry-level cars, Maruti Suzuki will launch a new sports utility vehicle (SUV) and a light commercial vehicle (LCV) next year.

"Next year we are launching our new SUV. That's a new area for us and it's a challenge. Of course, our core is entry-level cars and mini cars, which is an important area for us; we have to develop those of kind of products continuously. But at the same we need to add segments because Indian customers are upgrading and we have to satisfy our customers and hence we developed Ciaz," said Ayukawa.

Enhancing its offerings in the SUV segment, the company will launch its compact SUV in early 2016. The company believes that the move will help in maintaining its market share. Despite the slowdown in the economy and increased competition, Maruti Suzuki has gained share.

"Every year we will have to challenge ourselves. When I joined as MD, our share was 39-40%, now its 45%, we are constantly trying to increase our presence," said Ayukawa.

The company will also enter the LCV segment next year. However, it expects volumes to come gradually. About the launch, he said, "LCV also is a new challenge for us, we have no experience, but it takes time to develop our network. In the short term, a big number will be difficult. We will start gradually on small number for LCV next year."

The company is also looking to increase its share of exports from its India operations, as aims to make the country as export hub. Currently, Maruti Suzuki exports 10% of its overall production from India and plans to take the number to 15% in the next five years.

Seminar on Indirect Taxes

Our Correspondent : 11 Oct 2014, Bhopal

Confederation of Indian Industry-Southern Region is planning to organize a seminar on the key challenges in Indirect tax laws in India. The sessions would include an analysis of the critical issues faced by the industry at large on valuation, credits, refunds etc and a few recent tax controversies. CII would consider the critical points arising out of the deliberations for appropriate representation.

Kindly note, the Chief Commissioner of Central Excise & Service Tax, Chennai has confirmed to address and interact with the audience during the session.

Topics of discussion and speakers addressing the session

|

Key note Address |

Mr K Ananthapadmanabhan, IRS

Chief Commissioner of Customs and Central Excise- Chennai |

| GST – Key developments, expectations and the way forward |

Mr K Vaitheeswaran,

Advocate |

| Valuation of goods under Central Excise – (FIAT Ruling applicability, inclusion of freight, discount, expenses incurred by

dealers, treatment of State tax incentives, Issues in MRP based valuation) |

Mr K K Sekar,

Head – Indirect Taxation,

Ashok Leyland Limited |

| Contract manufacturing and Job work arrangements – Valuation and Cenvat Credit issues |

Mr B Sriram,

Partner,

Ersnt & Young LLP |

| Foreign Trade Policy – Key Incentives to Manufacturers and Service Providers |

Mr Sivakumar Ramjee,

Head Taxation

Gamesa Wind Turbines Pvt Ltd |

| Deemed sales and overlapping of taxes on goods and services – Taxing Principles (works contracts, Intellectual Property, software etc.) |

Mr Sanjay Kumar Agarwal , IRS

Commissioner,

Service Tax, Chennai

Mr N Prasad, Advocate

C Natarajan & Co. |

| Input taxes – Alternate duty benefit schemes (Cenvat credit/rebate/refund etc – Opportunities and challenges) |

Mr K Sivarajan,

Partner,

BMR & Associates LLP |

Registration details:

Registration fee per delegate(including service tax)

CII Member: Rs 3371/- | Non-member: Rs 4494/-

Request, to register online- Use the below link to register:

http://www.cii.in/OnlineRegistration.aspx?Event_ID=E000022584

US, UK to run joint model testing for fallout from big bank collapse

Our Correspondent : 11 Oct 2014, Bhopal

Regulators from the United States and the United Kingdom will get together in a war room next week to see if they can cope with any possible fall-out when the next big bank topples over, the two countries said on Friday. Treasury Secretary Jack Lew and the UK's Chancellor of the Exchequer, George Osborne, on Monday will run the first-ever joint exercise simulating how they would prop up a large bank operating in both countries that has landed in trouble. Also taking part are Federal Reserve Chair Janet Yellen and Bank of England Governor Mark Carney, and the heads of a large number of other regulators, in a meeting hosted by the US Federal Deposit Insurance Corporation.

"There is no doubt that in 2008 the judgment taken by my predecessor and others was that banks like the Royal Bank of Scotland and others were too big to fail," Osborne said. "Now I want to make sure that we have real options, and that we are able to avoid bailing in taxpayers with a bailout. And I'm pretty confident that's the case now," he said.

Six years after the financial crisis, politicians and regulators around the globe are keen to prove they have created rules that will allow them to let a large bank go under without spending billions in taxpayer dollars. They have forced banks to ramp up equity and debt capital buffers to protect taxpayers against losses, and have told them to write plans that lay out how they can go through ordinary bankruptcy. The plans are so-called living wills. Yet salvaging a bank with operations in several countries - which is the norm for most of the world's largest banks such as Deutsche Bank, Citigroup Inc and JPMorgan - has proven to be a particularly thorny issue.

Regulators may not be used to talking to each other, and there have also been suspicions that supervisors would first look to save the domestic operations of a bank, and would worry less about units abroad. One scenario would test the hypothetical failure of a US bank with UK operations, and a second the demise of a large UK bank with US operations, the countries said. Results would be communicated after the exercise.

The exercise comes as regulators are about to bring to fruition further initiatives to make banking safer. The first would force banks to have more long-term bonds that investors know can lose their value during a crisis, on top of their equity capital, to double their so-called Total Loss-Absorbing Capacity (TLAC). A second measure, expected to be announced this weekend, will force through a change in derivative contracts, which in their current form protect investors, and complicate the winding down of a bank across borders.

Now Sears says its Kmart stores hit by data breach

Our Correspondent : 11 Oct 2014, Bhopal

Sears Holdings Corp said it was the victim of a cyberattack that likely resulted in the theft of some customer payment cards at its Kmart stores, the latest in a series of computer security breaches to hit US companies and dealing a fresh blow to the struggling US retailer. The US Secret Service confirmed it was investigating the breach, which occurred in September and compromised the systems of Kmart, which has about 1,200 stores across the United States.

The breach did not affect the Sears department store chain. A Sears spokesman said he could not say how many credit and debit card numbers had been taken. He added that the personal information, debit card PIN numbers, email addresses and Social Security numbers of its customers remained safe.

Security professionals said they were not surprised to learn that yet another major retailer was reporting a breach, adding they believe many big merchants do not have adequate systems for detecting cyberattacks, which means they still remain easy prey for hackers. "This is going to continue indefinitely until people change their practices," said Shawn Henry, a former senior cyber cop with the FBI who is now of the president of cyber forensics firm CrowdStrike Services. He said that hackers are able to get into networks because they are "so broad and vast" that attackers will always find a way in. Retailers need to do a better job of quickly detecting them before they begin to steal data, he said.

Sears said that the attackers used malicious software that was undetectible using anti-virus software, highlighting the challenge of keeping up with the evolving techniques of computer hackers. Company spokesman Chris Brathwaite said Sears had been upgrading its systems even before the recent spate of incidents involving retailers, which included a massive breach of the systems of Target Corp in late 2013. "Our IT team was able to quickly remove the malware and we are deploying further advanced software to protect our customers' information," Brathwaite said.

Security experts say retailers have traditionally not invested enough in security, partly because of the industry's relatively thin profit margins. The breach comes as Sears is struggling to revive itself under Chief Executive Eddie Lampert, who has been closing stores and slashing costs to try to return to profitability. Critics say Lampert has been investing too little in the Sears and Kmart stores, contributing to nine straight quarterly losses.

Tom Kellermann, chief cybersecurity officer with security software maker Trend Micro, said that retailers need to be prepared to deal with malicious software crafted specifically for the purposes of burglarizing retailers. "It is debatable whether they had sufficient security in place to thwart these thieves. The real question that needs to be asked is why haven't they learned the lessons from the attacks on Target and others."

Kmart apologized to its customers on Friday and said it was working with federal authorities, banking partners and security firms in the probe. On Thursday, restaurant chain Dairy Queen, owned by Berkshire Hathaway Inc, confirmed that it may have compromised payment card information of customers across 46 US states. Other widespread breaches include those of Home Depot Inc, Michaels Stores Inc and Neiman Marcus.

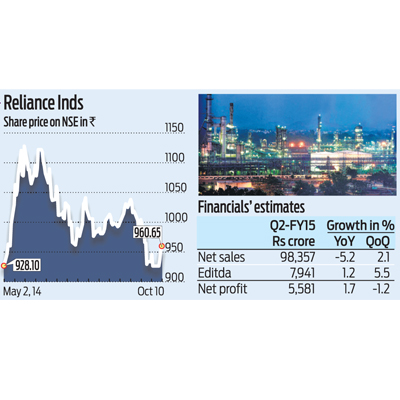

Petchem gains may rescue RIL's lacklustre Q2 show

Our Correspondent : 11 Oct 2014, Bhopal

The second quarter (July-September) earnings of Reliance Industries (RIL) will be weighed down by sharp fall in crude prices and drop in refining margins, but improvement in petrochemical margins is expected to trim the damage, analysts said.

The refining and petrochemical major's standalone net profit in July-September is seen falling by 1.2% sequentially at Rs 5,581 crore, but up by 1.7% from a year ago quarter, according to Bloomberg average of 14 brokerage estimates. RIL's revenues are seen improving 2.1% from a quarter ago to Rs 98,357 crore, but down 5.2% on-year basis due to rupee appreciation and weaker crude price.

"Petchem margin gains would negate the decline in refining profitability and fall in KG-D6 output. Gross refining margins (GRM) for second quarter are seen falling six cents to $8.1," Dhaval Joshi, an analyst with Emkay Global said.

Other brokerages are expecting GRM's in the range of $7.7-$8.3 per barrel as compared to $8.7/bbl in April-June and $7.7 in year ago quarter. Decline in product cracks (difference between price of crude and petroleum products) mainly caused GRM fall. Brent crude dropped 7% y-o-y to average $102 a barrel.

"Benchmark Singapore GRMs have declined 18% QoQ to $4.7/bbl level on declines in cracks for almost all key products (except LPG and fuel oil). Light-heavy crude spreads have declined as well, primarily Arab light-heavy and Brent-Maya," ICICI Securities observed, indicating a sequential decline of 25% in RIL's refining EBIT for the quarter.

Petrochemical (considered cash cow for the company) profitability would see stellar growth mainly on sharp improvement in polymer and polyester spreads. Olefins sharply improved led by PE (up 19% QoQ) and polypropylene polymer (up 10% QoQ). Petrochemical EBIT is expected to expand 30% QoQ.

The Mukesh Ambani owned company's exploration and gas business, facing tough times due to sharp fall in gas production from its Krishna Godavari-D6 basin, would see slight decline, brokerages said. Gas production from KGD6 is seen falling to 12.5 mscmd from 13.1 mscmd in June quarter.

"We estimate standalone PAT to remain largely flat sequentially. However, consolidated PAT to decline marginally due to consolidation of expected losses at Network TV18," Morgan Stanley said in a report.

Most brokerages would look for E&P road map of the company in view of delay in gas price hike, update on launch of 4G services, updates on polyester/intermediaries capacities commissioning, status on petcoke gasification.

RIL stock has under performed benchmark Sensex over the past six months, falling 16% following deferment of gas price hike and drop in regional refining margins. Gas price hike and recovery in refining margins are seen to be near-term catalysts for the stock. "Commissioning of expanded capacities in petrochemicals and refining will drive RIL's earnings growth and valuations in FY16 and FY17. We estimate RIL's FY14-17e EBITDA CAGR at 24% driven by capacity expansions," Deutsche Bank said. The brokerage sees a gas price of over $6.5/mmbtu as necessary to enable monetisation of RIL's deepwater discoveries.

Sikka calls for design thinking for transformation

Our Correspondent : 11 Oct 2014, Bhopal

Charting out a new direction and road for the growth of Infosys, CEO and Managing Director Vishal Sikka, on Friday, said there was a need for design thinking with thrust on all pervasive digital transformation that could reshape the software industry. “We see that the world around us is driven by software and software-driven technologies in a fundamental and profound manner… that transformation is affecting every industry and business... and there is a great opportunity for every company to transform,” he said after releasing the first quarterly results here..

Stressing the need and importance of culture in transformation, Mr. Sikka said, “No company can transform itself unless its workforce and culture move into the next generation. To re-skill this workforce and get them to think differently and understand, the new business realities and models you need to learn.”

“We believe that we are also going to need the renewal of our processes, of the way we operate, our internal system and processes, the way we engage with our employees and customers. We are also increasing our focus on education, learning and the way we focus on our employees,” he added.

To a query Mr. Sikka said “I think it is wrong to think of the new strategy in the context of any of the work that we did in the past. There is nothing radically different that I am proposing. I prefer not to look back on what Infosys 3.0 was or was not. What we have set out is ideas that are relevant to the clients.”

Terming Infosys as a next generation company with tremendous potential, he said, “We aspire to become the best of an excellent service company. I believe we will get back to that level. We will be focusing on consistent profitable growth. We aspire to go back to that and once again become the bellwether in the Indian IT industry.”

The company CEO also said M&A did not play a major role in transformation. However, it was key for growth.

According to the company, it will partner or acquire start-ups in any part of the world.

“The work with regards to the start-ups has three different dimensions to it. Firstly, we, at Infosys, can be a great accelerator to the roadmap for start-ups. We can be a great enabler to get them to their roadmap faster. We work with several start-ups in this dimension already. Second dimension is to bring the start-ups to our clients. So joint go to market is something we can do, and we are already doing,” he said.

Fair winds, but slow pick-up: Rajan

Our Correspondent : 11 Oct 2014, Bhopal

On a day when official data showed further weakening of the industrial sector, Reserve Bank Governor Raghuram Rajan said here on Friday that the Indian economy was expected to weaken further and a recovery was likely only beyond December.

He cautioned that despite the sharp surge in sentiment in the economy, captured by consumer and investor confidence surveys, including by the Reserve Bank, a pick-up in investments would take time.

“We have to accept that recoveries are not straight-line recoveries … there is volatility around the general trend … investment is yet to pick up on a strong basis, [though] we are seeing signs of the coming together of conditions for it [including a stable government that has signalled pro-investments initiatives] … there will be slight weakening compared with the first quarter in the second and third quarters, but beyond that we will hopefully see some strengthening of the economy,” he told The Hindu in an interview here.

Dr. Rajan is here to attend the International Monetary Fund (IMF) and World Bank Group annual meetings.

Slowing output

Official data released in New Delhi on Thursday showed factory output growth slowed further to 0.4 per cent in August, marginally lower than the 0.5 per cent in July.

Manufacturing growth shrunk further by (-)1.4 per cent compared to (-)1.1 per cent in July. Capital goods production slid sharply by (-)11.3 per cent against (-)3.8 per cent reflecting an absence of investment activities. Consumer goods production since April is down (-)4.9 per cent against (-)1.6 per cent, indicating household demand continues to weaken sharply.

“Even with all the sentiment in the world, it takes time for investment intentions to pick up and investors to put the assets on the ground. Consumer demand can quickly pick up but it is affected by new jobs,” Dr. Rajan said. In its Monetary Policy Report released on September 30, the Reserve Bank had said that consumer expectations were at the highest level since the financial crisis in 2008 and business expectations were at an 11-quarter high. The National Democratic Alliance government had announced a number of initiatives to improve the ease of doing business in India to back up Prime Minister Narendra Modi’s invitation to global manufacturers to “Make in India.”

It, however, said that its own expectations of conditions conducive to revival in investments, fiscal consolidation and sustained disinflation remained “broadly unchanged” from the pre-election level because of which it was not revising upwards its April projection for 2014-15 growth of 5.5 per cent.

Alibaba IPO ranks as world's biggest after additional shares sold

Our Correspondent : 20 Sep 2014, Bhopal

Alibaba Group Holding Ltd's initial public offering now ranks as the world's biggest in history at $25 billion, after the e-commerce giant and some of its shareholders sold additional shares.

Overwhelming demand saw the IPO initially raise $21.8 billion and then send Alibaba's stock surging 38 percent in its debut on Friday. That prompted underwriters to exercise an option to sell an additional 48 million shares, a source with direct knowledge of the deal said.

The IPO surpassed the previous global record set by Agricultural Bank of China Ltd in 2010 when the bank raised $22.1 billion.

Under the option, Alibaba agreed to sell 26.1 million additional shares and Yahoo Inc 18.3 million, netting the two companies an extra $1.8 billion and $1.2 billion respectively.

Alibaba's Jack Ma agreed to sell an extra 12.7 million shares and company co-founder Joe Tsai agreed to sell 902,782 additional shares, according to the prospectus.

The source declined to be identified as the details of the additional sale have yet to be made official. Alibaba declined to comment.

Citigroup Inc, Credit Suisse Group AG, Deutsche Bank, Goldman Sachs Group Inc, JPMorgan Chase & Co and Morgan Stanley acted as joint bookrunners of the IPO.

Rothschild was hired as Alibaba's independent financial advisor on the deal.

Bad loan sale by banks down to a trickle as RBI rules pinch

Our Correspondent : 20 Sep 2014, Bhopal

Stringent rules by the Reserve Bank of India (RBI) have pushed the sale of bad loans by banks to asset reconstruction companies down to a trickle. Lenders have barely managed to sell around Rs 500 crore in the second quarter (July-September) despite 20 banks showcasing Rs 25,000 crore of bad loans.

This is in stark contrast to Rs 15,000 crore worth of bad loans sold off in the auctions in the first quarter.

A few bilateral deals that private banks undertake with the ARCs are, however, out of the purview.

The sales are down after the central bank made it mandatory for ARCs to make an upfront payment of 15% of the cost of the asset so that only serious players remain in the business. Banks were unwilling to come down on the reserve price of the assets or increasing the management fee -- which is 1.5% of the cost of the loan. Earlier ARCs were aggressively bidding for 80% to 90% of the cost of the asset as they had to pay 5% cost of the asset upfront and also earn management fees of 1.5% of the cost which resulted in asset prices being sold at high prices.

A senior official of an ARC said, "Banks are not understanding the problem of the ARCs and they are toying around with high asset prices. Unless they reduce the reserve price which is bound to happen, no sales will take place. In some cases, banks are quoting a reserve price without any discounts. When sales continue to slacken, bank will become more realistic."

In the first quarter large corporate accounts like Hotel Leela Ventures and Bharati Shipyard are some of the accounts that had gone in for corporate debt restructuring (CDR) but were later auctioned off to the ARCs. Some of the high value loans that were showcased in the ARCs include Tech Pro System which had a loan of Rs 3000 crore.

A senior official from another ARC said, "The 15% cash payment upfront is like a capital investment. Earlier it was only 5% and the remaining amount was in the form of security receipts which can be encashed in 8 years time. But with higher cash payments banks need to rework on the pricing of the loan otherwise it will be difficult for the ARCs to acquire the assets. The 5% limit was like an agency fees so we are not sensitive to the pricing of the loan."

ARCs are trying to enhance their capital resources by mobilising resources from funds specialising in stressed assets.

A senior official from Arcil, the largest ARC, said, "Banks are unwilling to work on the valuations which is resulting in deals not getting concluded. When we have to pay up 15% then the valuations should be lower."

Alibaba which accounts for 80% online sales in China, surges 38% on massive demand in IPO

Our Correspondent : 20 Sep 2014, Bhopal

Alibaba Group Holding Ltd's shares soared 38% in their first day of trading on Friday as investors jumped at the chance for a piece of what is likely to rank as the largest IPO in history, in a massive bet on China's burgeoning middle class. It was an auspicious debut for the Chinese e-commerce company, which was founded by Jack Ma in his apartment in 1999 and now accounts for 80% of online sales in China.

About 100 people gathered outside the New York Stock Exchange at Wall and Broad Streets, many of them Chinese tourists with cameras, and they cheered and snapped photos when Ma exited the building with the kung fu star Jet Li. The stock opened at $92.70 shortly before noon ET (1600 GMT) and quickly rose to a high of $99.70, before paring gains to close at $93.89. Some 271 million shares changed hands, more than double the turnover on Twitter Inc's first day last year, although still short of volume for the General Motors Co and Facebook Inc IPOs.

"This is the most anticipated event I've ever seen in my 20-year career on the floor of the NYSE," said Mark Otto, partner with J. Streicher & Co, who trades on the NYSE floor. "I think today's move is sustainable: The company is profitable, unlike some of its competitors, and it is a way for traders to tap into the Chinese growth story."

The pricing of the IPO on Thursday initially raised $21.8 billion for Alibaba. Scott Cutler, head of the New York Stock Exchange's global listing business, told CNBC that underwriters would exercise their option for an additional 48 million shares, to bring the IPO's size to about $25 billion, making it the largest initial public offering in history.

But a source close to the matter said the underwriters would make a final decision on whether to exercise the option over the next week or two, based on how the shares trade over the next few sessions.

Alibaba is nearly unknown to most Americans but is ubiquitous in China. The company, which operates China's largest Internet shopping destination, Taobao, and retail site Tmall.com, earned $3.7 billion in the 12 months ended March 31, 2014, up about $2 billion from the prior 12-month period.

At its closing share price on Friday, Alibaba has a market value of $231 billion, exceeding the combined market capitalizations of Amazon and eBay, the two leading U.S. e-commerce companies.

Alibaba is valued at 39 times its estimated earnings per share for its current fiscal year, which ends in March. That is right in line with Facebook's valuation of 39 times forward earnings but nowhere near the lofty valuation of Amazon.com's multiple of 264, according to Thomson Reuters Starmine data.

Bandhan to be ready with 600 branches before banking debut

Our Correspondent : 20 Sep 2014, Bhopal

The Kolkata-based Bandhan, one of the two firms (other being IDFC) to get the RBI nod earlier this financial year to start banking operations, is planning to launch its bank before the next festive season in 2015. In order to make a big impact ahead of the start of its full-fledged lending business, the micro finance firm is already in a frenzy setting up branches, all of which would be opened at one go.

"We would be launching the bank by September next. And it has to be an impactful affair. There is no other option," Chandra Shekhar Ghosh, founder of Bandhan micro-finance, told dna about the proposed start of the bank.

Along side the high-impact inauguration of the bank, Bandhan is also simultaneously looking to open 600 branches all at one go.

"We plan to start off with 600 branches at one go to make the necessary impact," Ghosh said on the sidelines of CII Banking Colloquium in Kolkata.

"It's like making a ship. You have to build the whole of it in the dry dock and then sail it. A ship can't be build in bits and pieces in water," Ghosh said.

There is also a compelling reason for opening all the branches before the formal start of the banking operations.Following the launch of its bank, the 58 lakh existing micro-finance customers will be transferred from the micro-finance outfit to the new bank.

And all of its customers would be provided with banking infrastructure.As of August end, Bandhan has over 58.16 lakh borrowers spread across 22 states serviced through 2,016 branches generating a loan book outstanding of Rs 6,446 crore.Ghosh is hopeful of completing setting up of the branch network on time.

"We had started hunting for premises through a special team we had set up even before we got the banking licence. So, we are hopeful of completing the process in time."Even as Ghosh plans for a big launch, he is counting every paisa that he spends.To, illustrate, Bandhan hasn't spent on a headhunter despite being faced with the challenge of recruiting a full-fledged bank.

"Appointing a headhunter would have cost me much in terms of commissions paid to them against each recruitment. Instead I chose to advertise on newspapers and got 35,000 applications, " he said.

Bandhan, however, appointed Aon Hewitt, a human resource consultant to design compensation and benefit levels.

Banks to be careful about Jan Dhan Yojana: RBI

Our Correspondent : 20 Sep 2014, Bhopal

The Reserve Bank on Friday warned the banks to be more careful while opening accounts under the Jan-Dhan Yojana, saying that a single individual could open multiple accounts in the lure of Rs 1 lakh insurance cover.

“There are some caveats when the banks are implementing the financial inclusion scheme under the recently launched Jan-Dhan programme,” RBI Executive Director P Vijay Bhaskar said at a CII seminar in Kolkata on Friday.

He said people could open accounts in different banks using different identity documents like PAN card, Aadhar among others in the lure of getting insurance cover of Rs 1 lakh from all the banks.

The banks should have a single information sharing system by which this possible misuse could be stopped. Another possible threat was ‘smurfing’, the RBI official said.

In this case, hawala operators would spilt the whole amount into several small units beyond the threshold using several bank accounts and send money overseas.

The last was ‘money mules’ by which an individual would operate through another person’s bank account.

Talking about the north-eastern region, he said the SLBCs and the SLCCs should take steps to improve the credit-deposit ratio of the region as the CD ratio was much lower than the national average.

Earlier this week, RBI Governor Raghuram Rajan had cautioned banks on the risks involved in just hunting for numbers with regards to Jan Dhan scheme, asking them not to compromise on core objectives of the programme.

“When we roll out the scheme, we have to make sure it does not go off the track. The target is universality, not just speed and numbers,” Dr Rajan had said.

The scheme can be a “waste” if it leads to duplication of accounts, if no transaction happens on the new accounts and if the new users get bad experiences, he had added.

Kishore Biyani enters FMCG segment; will set up food processing chains

Our Correspondent : 19 Sep 2014, Bhopal

Kishore Biyani, the maverick retailer who suffered several setbacks in recent times, is making yet another bet.The founder and CEO of Future Group is entering the fast moving consumer goods (FMCG) segment by setting up a chain of food processing parks, in an indication of potential shift from core business of retailing.

"Food processing will eventually become a bigger business than food retailing for us. The new business will see investments to the tune of Rs 1,000 crore over a period of time and is likely to gives us revenues of over Rs 20,000 crore in coming years," Biyani announced at the India Retail Forum 2014 summit on Thursday.

His first food processing park spread across 110 acre at Tumkur in Karnataka is ready for operations and will be inaugurated by Prime Minister Narendra Modi on September 24. The second one in Kolkata is in the works and will cater to the eastern region.

"We are in advanced stages of acquiring a huge land parcel in Madhya Pradesh and should be in a position to close the deal in another week's time," said Biyani, adding that the Tumkur food park will be a world class facility that integrates farm to plate, produce to processing, packaging to consumer with best infrastructure and technology.

On reasons behind transitioning from retail to FMCG, Biyani said FMCG companies enjoy margins ranging between 8% and 18%, while a retailer gets just a fraction of it.

"Our food processing foray will help us get those margins and we will sell these products from our food retail chain as well as through entities like Walmart, Metro cash and carry stores in addition to other stores that sell food and related products in the country," he said.

This apart, giving existing online retailers a run for their money, Biyani is expected to unveil something big in the e-commerce space on October 1, 2014.

"That will be a bigger event and will share details at the time of the launch," he told dna. The group is expecting revenues of around Rs 1,000 crore from e-commerce this fiscal.

Expressing optimism on the consumer electronics business, Biyani said the company's Ezone retail operations have picked up significantly and have already clocked in revenues of Rs 1,000 crore.

"We are targeting a run rate of over Rs 2,000 crore from Ezone this year," he said.

Fed reprieve, re-rating talk helps Sensex re-visit 27000

Our Correspondent : 19 Sep 2014, Bhopal

Stock indices gained over 1.8% after US Fed Wednesday said it would not immediately hike rates once it stops infusing liquidity through its bond-buying programme in October.

The decision to keep rates unchanged triggered rally in the domestic market, as worried investors in the past few sessions had resorted to profit taking amid concerns of a rate hike.

Mirroring the relatively positive Asian markets sentiment, the BSE Sensex re-captured the 27000-mark to end 486.92 points or 1.81% higher at 27112.21 on Thursday, while the broader S&P CNX Nifty ended at 8114.75, up 139.25 points or 1.75% higher.

The markets opened weak but started recovering later in the day. Dealers said the gains in the market were largely on account of short-covering and entry of long-ended fund buying like pension funds.

China's commitment to invest $20 billion in India over the next five years also aided the sentiment and led to a fresh round of rumours that India could get re-rated upwards by global rating agencies.

However, the euphoria appears to be short-lived as foreign institutional investors did not participate in the upsurge and were instead marginal sellers of equities.

According to the provisional data released by the exchange, FIIs were net sellers of equities on Thursday to the tune of Rs 9.57 crore, while domestic institutional investors bought Rs 84.45 crore worth of equities.

"The markets can now expect a weekend correction tomorrow (Friday) as the rally is unlikely to sustain without buying support from FIIs," said Arun Kejriwal of Kejriwal Research.

Thursday's run appears largely on account of diminishing fears amongst emerging markets that liquidity could dry up once US Fed bond-buying comes to an end in October. However, given the fact that Fed has decided not to hike interest rate, the money flow to emerging markets would remain unaffected, said dealers.

"The comfort provided by Fed in terms of a delay in potential US interest rate hike improved market sentiment," said UR Bhat, managing director at Dalton Capital Advisors.

Market participants said the markets have been on the decline since September 8, when it hit an all-time peak of 8180, largely on fears that dollar could strengthen against major currencies once US hikes rates. This in turn would make US bonds attractive and restrict money flows to emerging economies, said a treasury head at a foreign bank.

"The latest decision by Fed has brought about some reprieve to the sagging sentiments," he added.

With China and Japan having firm commitments on their investments in India, market players are still bullish on the markets.

"Structurally the bull run remains intact and under valued stocks in mid-caps should continue to pull the markets up," said G Chokalingam of Equinomics Research &Advisory.

According to Rahul Shah, vice president at Motilal Oswal, Nifty has pierced the crucial 8080 level and the next level it could go is 8250.

Rupee up 10 paise against dollar in early trade on September 19

Our Correspondent : 19 Sep 2014, Bhopal

Extending its rising streak for the the fourth straight day, the rupee strengthened by 10 paise to 60.74 against the US dollar in early trade today at the Interbank Foreign Exchange market on continued selling of the American currency by exporters.

A higher opening of the domestic equity market also supported the rupee but the dollar's rise against other currencies overseas capped the gains, dealers said.

Yesterday, the Indian rupee ended eight paise higher at 60.84 against the greenback following late dollar selling by exporters and a strong rally in local shares.

In previous three sessions, the rupee gained 29 paise.

Meanwhile, the benchmark BSE Sensex rose 73.39 points, or 0.27 per cent, to 27,185.60 in early trade.

Sensex extends gains, up 73 points in early trade; TCS, HCL Tech top gainers

Our Correspondent : 19 Sep 2014, Bhopal

The benchmark BSE Sensex today rose over 73 points in early trade, extending gains for the third straight day on sustained buying by funds and retail investors, driven by rising optimism over trade ties with China amidst a firming trend overseas. The 30-share index gained 73.39 points, or 0.27%, to 27,185.60 with power, realty, infrastructure, PSU, healthcare, and metal sector stocks leading the rally.

The index had gained 619.70 points in the last two sessions. In a similar fashion, the broad-based National Stock Exchange index Nifty moved up by 21.85 points, 0.27%, to 8,136.60. Brokers said sentiments remained upbeat as fears of capital outflows receded on US Fed's continued pledge to retain rates at low levels.

Rising optimism over trade ties with China also boosted sentiments, they said. Shares of Tata Steel, Tata Power, Tata Motors, TCS were in good demand and rose up to 1.97% after Moody's yesterday upgraded ratings of Tata Group firms.

IT firms have gained strongly with TCS, HCL Tech and Tech Mahindra featuring among top gainers.

Meanwhile, India yesterday signed a 5-year trade and economic cooperation agreement with China with a view to improve the trade balance and obtain US $20 billion Chinese investments.

In the Asian region, Hong Kong's Hang Seng index was up 0.69%, while Japan's Nikkei moved up by 0.68 points in early trade today. The US Dow Jones Industrial Average ended at yet another record high by rising 0.64% in yesterday's trade on Fed's continued pledge to retain raters at low levels.

Spencer's Retail exits western region; shuts flagship store in Inorbit Mall

Our Correspondent : 19 Sep 2014, Bhopal

Spencer's Retail, promoted by RP-Goenka Group, has shut its flagship store at Inorbit Mall at Malad, a Mumbai suburb. The hypermart format store spread across 40,000 square feet has ceased operations and the mall owners are currently awaiting the expiry of its lease agreement. The closure also means Spencer's has completely exited the western region for now.

A senior executive from Inorbit Malls India told dna that Spencer's was restructuring its business / operations and hence decided to shut down the store. "They wanted to resize and look at a smaller outlet probably at a different location. We haven't found a replacement yet and are exploring various options for the retail space that will get vacant in a few months from now," the executive said.

So will shutting down of Spencer's leave a vacuum in the mall's offerings to its customers? "Not really," said the executive adding, "we already have HyperCity in the vicinity that will cater to the requirements of people looking for related merchandise."

On the possible replacement(s), the executive said they have been turning down a lot of requests for housing retail brands in the mall and Spencer's vacating 40,000 sq ft gives them an opportunity to consider getting them on board while also enhancing their offerings. "We will now look at a combination of retail brands t0 be housed there," the executive said.

Oil prices down on United States stockpiles surge, OPEC reports

Our Correspondent : 18 Sep 2014, Bhopal

Oil prices fell in Asia today following an unexpected surge in United States stockpiles and reports that the OPEC oil cartel is unlikely to slash production when it meets in November. US benchmark West Texas Intermediate for October delivery dipped 55 cents to US $93.87 while Brent crude for November eased 51 cents to US $98.46 in mid-morning trade.

Prices were under pressure "after the US Department of Energy reported an unexpected increase of US crude inventories by 3.7 million barrels instead of the market forecast for a 1.2 million decline," said Singapore's United Overseas Bank (UOB) in a market commentary.

Gasoline stocks dropped 1.6 million barrels in the week to September 12, the data showed.

UOB said oil prices also took a hit after "conflicting reports" about the plans of the Organisation of the Petroleum Exporting Countries (OPEC) to cut its output in November due to a global supply glut and weak demand.

OPEC Secretary-General Abdullah El-Badri said Tuesday the cartel would cut output in November, which helped lift prices from a two-year low.

But a Dow Jones Newswires report yesterday, citing unnamed OPEC delegates, said the organisation was unlikely to cut in November.

A stronger dollar added downward pressure to oil, which is traded in dollars and becomes more costly for buyers using weaker currencies.

The greenback rose after the Federal Reserve stuck to its timetable on hiking interest rates but indicated they could eventually rise more sharply than initially envisaged.

Sanjeev Gupta, head of the Asia-Pacific oil and gas practice at consultancy EY, said investors will next be scrutinising manufacturing data out of China and Germany on Tuesday for clues about global demand.

If the economic data from these two countries are lower than forecast, oil prices "may head lower in the near term", said Gupta.

Sensex rises 200 points as Nifty crosses 8000; Jindal Steel, Hero Motocorp top gainers

Our Correspondent : 18 Sep 2014, Bhopal

After yesterday's rebound, the benchmark BSE Sensex gained over 194 points in early trade today as funds and investors booked profits in recent outperformers amid a mixed trend overseas. The 30-share barometer, which had gained 138.78 points in the previous session, fell by 118.09 points, or 0.44%, to 26,513.20.

On similar lines, the broad-based National Stock Exchange index Nifty gained 57 points to touch 8032.

The big gainers in the early morning trade are PNB, Jindal Steel, Hero Motocorp, Bank of Baroda and Kotak Mahindra Bank. The big losers are Infosys, United Spirits and HUL.

Every index other than IT were in green.

Among other Asian markets, Hong Kong's Hang Seng fell by 0.67%, while Japan's Nikkei moved up by 0.93% in early trade. However, the US Dow Jones Industrial Average ended at fresh record high by rising 0.15% higher in yesterday's trade.

Federal Reserve renews zero rate pledge, but hints at steeper rate hike path

Our Correspondent : 18 Sep 2014, Bhopal

The Federal Reserve on Wednesday renewed its pledge to keep interest rates near zero for a "considerable time," but also indicated it could raise borrowing costs faster than expected when it starts moving.

Many economists and traders had expected the United States central bank to alter the rate guidance it has provided since March, given generally improving data on the economy's performance.

But the Fed repeated its assurance that rates would stay ultra-low for a "considerable time" after a bond-buying stimulus program ends. In a statement after a two-day meeting of its policy-setting Federal Open Market Committee, it announced a further $10 billion reduction in its monthly purchases, leaving the program on course to be shuttered next month.

The statement was virtually unchanged from July, though new quarterly projections released with it showed the central bank's view on where interest rates should be in future years is diverging from where financial markets have bet they will be.

"While the much analyzed phrase 'considerable time' remained in the FOMC statement, the newly announced scheme for interest rate normalization shows that higher rates are in the cards," said John Kilduff, a partner at Again Capital LLC in New York.

Dallas Federal Reserve Bank President Richard Fisher and Philadelphia Fed chief Charles Plosser dissented, arguing the guidance on rates could tie the central bank's hands if it felt it had to move more quickly to tighten monetary policy.

The Fed has held benchmark overnight rates near zero since December 2008 and has more than quadrupled its balance sheet to $4.4 trillion through a series of large-scale bond purchase programs.

In a further sign the central bank is in no rush to start raising rates, the FOMC repeated its assessment that a "significant" amount of slack remains in the U.S. labor market.

Stocks were little changed after the statement, but the dollar hit its highest level against the Japanese yen since September 2008. Yields on U.S. Treasury bonds rose to session highs as traders moved to price in the possibility of higher future rates.

The most significant change was the new rate projections, which suggested officials were positioning themselves for a potentially faster pace of rate hikes than they had envisioned when the last set of forecasts were released in June.

For the end of next year, the median projection was 1.375 percent, compared to 1.125 percent in June, while the end-2016 projection moved up to 2.875 percent from 2.50 percent. For 2017, the median stood at 3.75 percent - the level officials see as neither stimulative nor restrictive.

By contrast, December 2015 federal funds futures imply an interbank lending rate of 0.745 percent at the end of next year. Contracts for December 2016 point to a rate of 1.85 percent.

Eric Lascelles, chief economist for RBC Global Asset Management in Toronto, called the 2017 projections a "shocker."

"I would have thought it would take a few more years to get all the way up to what they perceive to be a neutral rate," he said.

Fed Chair Janet Yellen played down the shift in a news conference after the statement was released.

"I would say there is relatively little upward movement in the (federal funds rate) path," she told reporters. "I would view it as broadly in line with what one would expect with a very small downward reduction in the path for unemployment and a very slight upward change in the projection for inflation."

Raghuram Rajan says it is important to have FII debt limits

Our Correspondent : 17 Sep 2014, Bhopal

Cautioning about reliance on foreign flows, Reserve Bank Governor Raghuram Rajan today advocated for continuing with caps on overseas investments in debt."...we are limiting our reliance on foreign debt. It is important we keep it this way and manage the economy in way that is careful and that is circumspect," he said during an address at the 55th foundation day celebrations at the Somaiya Vidyavihar.

The Reserve Bank had in July raised the Foreign Institutional Investors' debt limit by USD 5 billion to USD 25 billion, after the investments started nearing the USD 20 billion threshold.

According to reports, the additional headroom is almost exhausted and FIIs' debt investments in the country are already nearing the USD 25 billion, leading to expectations that there might be an increase in the cap again.

Rajan said that the country has benefited from the foreign flows into the country, but advised caution, while dealing with such investments, which chase the best yields.

"We have to be careful about this money because if we say, 'this is wonderful, they all like us, we follow tremendous policies and that's why we got this money', and we go and spend, we run large current account deficits based on these foreign borrowings," he said.

"But this foreign borrowing cannot be taken for granted. At some point these investors will find greater usage of their money back home and they want to go out once again," he added.

Rajan, however, said that through various measures we have been successful in "substantially" containing the current account deficit ( CAD), which narrowed to 1.7 per cent in FY'14 from an all time high of 4.8 per cent in the previous fiscal.

Sensex rebounds 127 points in early trade on global cues; NMDC top gainer

Our Correspondent : 17 Sep 2014, Bhopal

After two sessions of losses, the benchmark BSE Sensex recovered sharply by over 127 points in early trade today on emergence of buying by funds and retail investors amid a firming trend in other Asian markets.

The 30-share index, which had lost 568.53 points in the previous two sessions, rose by 127.37 points, or 0.48 per cent, to 26,619.88, with all sectoral indices, led by realty and metals, trading in positive zone with gains up to 1.37 per cent.

Also, the National Stock Exchange index Nifty gained 39.10 points, or 0.49 per cent, to 7,972. Brokers said a firming trend in the Asian region, tracking overnight gains in US markets boosted by speculation that the Fed is unlikely to start raising interest rates soon, influenced the sentiments here. Prominent gainers that supported the Sensex were Infosys, NMDC, TCS, Hindalco, HeroMotoCo, Mahindra and Mahindra, RIL, SBI and Sun Pharma.

The big losers are Jindal Steel, Cipla, BPCL, Sesa Sterlite.

Among other Asian markets, Hong Kong's Hang Seng was up by 1.01 per cent while Japan's Nikkei rose 0.23 per cent in early trade today. The US Dow Jones Industrial Average ended 0.59 per cent higher in yesterday's trade.

Lupin in deal to develop product portfolio for Merck

Our Correspondent : 17 Sep 2014, Bhopal

Agreement can add up to 20 new products to the current portfolio and will cater to 4-5 key therapeutic areas, Pharma major Lupin said it has entered into a long-term strategic partnership with Merck Serono, the biopharmaceutical division of Merck, for implementing the Germany-based company's general medicines portfolio expansion initiative in emerging markets. The company is also looking at expanding its presence in Russia, Turkey and China, though no definite plan is in place at the moment for the latter, said a senior company official.

Vinod Dhawan, group president, Asia Pacific, Africa, Middle East, & Latin America (AAMLA), Lupin told dna, "We have a good relationship with Merck Serno for sometime and we have earlier developed some products for them.

We have worked together for the last four years in markets like Brazil and Mexico and they are satisfied with us. So we thought of taking this relationship at the global level. This is a 10-year old agreement which can be renewed."

As per the agreement, Lupin will develop products, provide product dossiers and supply finished products to Merck Serono, which will then market the products, leveraging its strong commercial and medical teams in emerging markets to bring new medicines in its portfolio to customers, Lupin said in a press statement.

Lupin will receive upfront and milestone based licensing fee. However, both companies have agreed on not to release any financial details of the transaction.

Dhawan said, "We will explore some more product opportunities with them, but we are not looking at any more markets with them at the moment. As per the agreement, we can add up to 20 new products to the current portfolio but we can increase it as we go ahead. The agreement will cater to 4-5 key therapeutic areas, such as cardiovascular, diabetes, endocrinology etc." The first product launches are expected in 2016.

The partnership would cover major markets such as Brazil, Mexico, Indonesia, Philippines alongside several countries in Africa and Central Eastern Europe as well as other countries in emerging markets. Sales in the emerging market regions are one of the key growth drivers for Merck Serono, amounting to close to 1.8 billion euro in 2013.

Dhawan also said that Lupin is looking at strengthening its presence in Japan, Brazil, Russia, Turkey and China through acquisition or strategic partnerships. "In terms of geographical expansion, Brazil, Russia and Turkey where we are interested. We are closely examining China though we have no definite plan. We have a small presence in Russia and Turkey historically but those are large markets and we are examining ways that will allow us to have a larger critical mass so that we can develop much faster. But we are talking to a number of players. But we are definitely not looking at any big acquisitions."

"The kind of acquisitions that would make sense to us in most of these markets will ideally be between $50 million and $80 million of sales," he added.

Ranjit Kapadia, senior VP – pharma, Centrum Broking, said, "The deal will be beneficial to both companies. Lupin will be able to make more capacity utilisation and its per unit costs will come down. For Merck, it would be able to keep a low price for the product. Emerging market is price-sensitive market and Merck would be able to take advantage of Lupin's low cost manufacturing base in India. The effect of this partnership will start showing in 2016-17. But as per the upfront payment, Lupin should get some payment immediately depending on the kind of agreement it has entered. The other milestone payment will come as and when it will develop the dossiers."

Wockhardt chairman has no plans to sell its business

Our Correspondent : 16 Sep 2014, Bhopal

Wockhardt chairman Habil Khorakiwala, on Monday, said the company has no intention of selling its business. The statement comes at a point when various news reports had suggested that the company may sell off some of its assets. Some of the names which were rumoured as potential buyers to buy the assets are Mylan, Pfizer, Teva and even the home-grown Lupin.

"I don't see why do I sell any part of my business ever. We have a good R&D in place and also there are very nice product related opportunities. Besides, my succession plan is in place. So, why would I be selling any part of my business ever," Khorakiwala told reporters on the sidelines of the company's annual general meeting.

According to a report by Bloomberg last month, Lupin, the second-largest drugmaker by market value in India, studied Wockhardt as a potential acquisition candidate, although it hasn't met the company's management and did not hold any talks. Earlier, there were reports that the Mumbai-based drugmaker Wockhardt was in talks with global multinationals to sell off some of its assets.

The company is recently facing import alerts at two of its facilities in India namely Waluj and Chikalthana in Aurangabad. Last year, United Kingdom Medicines and Healthcare products Regulatory Agency (UK MHRA) withdrew its quality certification to the Chikalthana unit. The MHRA has visited the facility recently and a response from them is expected in sometime soon.

"By and large we have not received any critical observation from the MHRA. Other observations are there and we are correcting it. We will hope to get their responses in the next few quarters," said Khorakiwala.

Talking about its R&D spends, the company said it is currently at 10% of its total revenue. "Irrespective of my revenue, my R&D will go up. At present it is 10% and it will remain more or less in the double digit for the next three years," the chairman added.

Bankers taking too long to recognise frauds, says RBI governor Raghuram Rajan

Our Correspondent : 16 Sep 2014, Bhopal

Reserve Bank of India (RBI) governor Raghuram Rajan on Monday said bad economy, poor structuring and slowdown in the government is leading to creation of bad loans.Speaking at the Federation of Indian Chambers of Commerce and Industry-Indian Banks Association banking seminar on Monday, he said allegations of malfeasance like Syndicate Bank cases are impacting the accretion of bad loans in the system.

"I fear that banks are taking too long to recognise frauds in the banking system. There are lots of good people in public sector banks, but need to root out the bad apples, bad practices and weak capabilities. There is a significant rise in NPAs in large projects. Let's not hide the problem, we have given a lot of forbearance to large projects," Rajan said.

Some of the big NPAs in the recent past were Zoom Developers, Winsome Diamonds, Deccan Chronicle and Mahua TV, all of which were discovered after the loot was complete.

"Many sectors in the economy get too little credit. Solution is to develop the financial framework across the board. Should a student loan to study abroad come the under priority sector?," Rajan asked, touching upon the issue of distortion in loan pricing.

Certain sectors of economy like agriculture need credit. Select special sectors need ease of credit; the biggest need for agriculture is long-term money while farmers do not get long-term loans because short -term loans are subsidised, he said.

Interest subventions and loan waivers schemes, Rajan said, would distort prices and lead to unhealthy borrowing practices.

Arundhati Bhattacharya, chairman, State Bank of India, said, "Immediately after a loan waiver scheme the agriculture credit from the banks go down as bankers expect farmers to default expecting another loan waiver. It kills the discipline that the borrowers need to have while borrowing from the banks."

Banks have to direct 40% of the total credit to the priority sector, which includes agriculture, education, rural housing, micro and small sector enterprises.

Rajan cautioned banks on duplication of accounts under the Pradhan Mantri Dhan Yojna, which he said is an internal priority as it would help in direct benefit transfers that will reduce leakage.

He said it was time that the government deregulated diesel prices in the wake of falling global crude oil prices. The fall in inflation has been consistent with RBI's forecast.

It is not just food prices that is keeping inflation high. A whole host of services like medical services, education, travel, hotel and other products are expensive, according to RBI governor.

"The industry therefore should to cut prices to bring down inflation. But will they do it?" he asked.

"I don't want to keep interest rates high. We will bring down interest rates when it is feasible. Right now, inflation is high and the priority is to bring it down, so that growth can revive. We don't have to wait till inflation is down to bring down prices, but we need to be certain that inflation is coming down before interest rates soften," Rajan said.

Sensex slips below 27,000 level

Our Correspondent : 15 Sep 2014, Bhopal

The benchmark BSE Sensex tumbled over 185 points to dip below the 27,000-mark in early trade on Monday on selling by funds and retail investors after industrial production growth slowed to 0.5 per cent in July amid a weak trend in the Asian region.

The 30-share barometer slipped below the 27,000-mark by falling 185.55 points, or 0.69 per cent, to 26,875.49 with metal, FMCG, power, capital goods and IT stocks leading the fall.

The index had gained 65.17 points in the previous session on Friday.

On similar lines, the National Stock Exchange index (Nifty) moved down by 70.95 points, or 0.88 per cent, to trade below the 8,100-mark at 8,034.55.

In the metal sector, stocks of Tata Steel fell 2.19 per cent, Sesa Sterlite shed 1.33 per cent and Hindalco lost 2.43 per cent in early trade.

Brokers said selling activity emerged largely on disappointing economic data as the country’s industrial production growth slowed to 4-month low of 0.5 per cent in July but easing retail inflation to 7.8 per cent in August from 7.96 per cent in July, restricted the fall.

Besides, a weak trend on other Asian bourses after data showing Chinese industrial output expanded in August at its slowest rate since the global financial crisis, influenced the sentiments, they said.

Among other Asian markets, Hong Kong’s Hang Seng index was down by 0.75 per cent in early trade, while Japan’s financial markets are closed on Monday for a public holiday.

Timely subsidy payments put oil marketing companies on profit path

Our Correspondent : 15 Sep 2014, Bhopal

State-owned oil marketing companies (OMCs) are on a high as timely subsidy payments by the government and reduction in diesel under-recovery over last few months have helped them reduce dependence on lenders.